Shares of Synovus Financial (NYSE:SNV) have been a poor performer over the past year, losing about 30% of their value, in sympathy with regional banks. Ever since the failures of Silicon Valley Bank and First Republic, there has been a fiercer competition for deposits. While SNV has held onto deposits, they have become far costlier, pressuring margins. Given the potential for more credit losses, I view shares as a hold.

Seeking Alpha

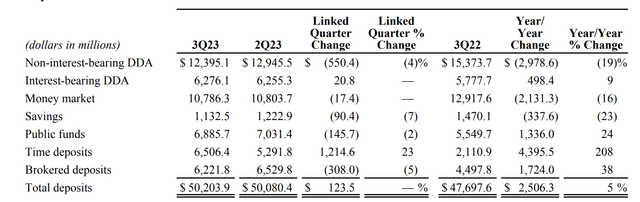

In the company’s third quarter, Synovus earned $0.84 in adjusted EPS, which missed estimates by $0.02. This was down from $1.34 last year. In the battle for deposits, Synovus has actually acquitted itself fairly well. It ended Q3 with deposits of $50.2 billion. Deposits are impressively up 5% from last year and 0.2% sequentially whereas most banks in the industry are seeing 0-5% declines. Synovus’s position has been aided by the fat that 55% of deposits are insured, and a further 31% are collateralized, which makes them less susceptible to concerns about a bank’s credit quality.

While Synovus is retaining and growing deposits, they are becoming costlier. The first reason for this is mix shift. While its deposit base has grown, noninterest-bearing deposits (NIB) have fallen by $3 billion while interest-bearing (IB) deposits have grown. NIB accounts tend to be transactional in nature, for instance, an account used by a company to make payroll. When rates were near 0%, companies may have kept extra funds in these accounts as there was little opportunity cost. Now, with treasury bills yielding over 5%, there is incentive to carry the lowest possible balances in these accounts and invest elsewhere in IB accounts.

Synovus

Ultimately, there should be a floor to how far these balances can fall as there are minimums needed in order to be able to fund weekly or monthly transactions. Unfortunately, Synovus has not quite hit that floor yet with NIBs falling a further $589 million while interest-bearing deposits rose $712 million in Q3. This shift away from NIBs adds over $80 million in interest expense to Synovus’s cost structure.

Alongside the mix shift, Synovus has had to pay up for interest-bearing deposits, though the pace of these increases is starting to moderate as the scramble for deposits has calmed down. Deposit costs were up 35p sequentially to 2.31%. This is up from 0.88% at the start of the year. They ended the quarter at 2.41%, and with betas moderating, we should a smaller rise in Q4 relative to Q3. It is a positive that Synovus is winning deposits; I view stable deposits as an essential prerequisite to investing in the regional banking sector. This retention has come at a cost, though.

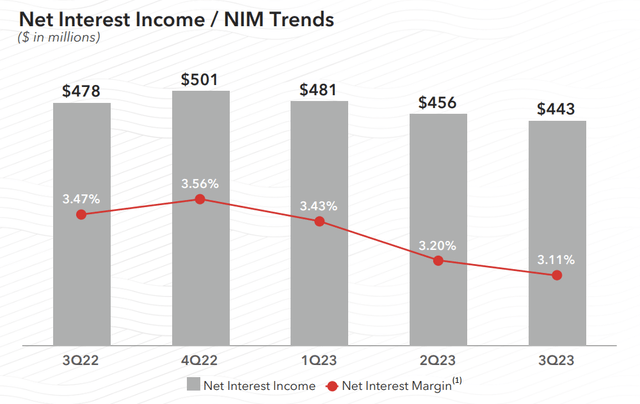

Because of higher funding costs, Synovus’s net interest margin (NIM) has been squeezed, coming in at 3.11% last quarter. This 9bp compression in Q3 was substantially better than the 23bp last quarter as wholesale funding needs declined, but as you can see, NIM has compressed by 45bp since the end of the year, reducing net interest income by $58 million

Synovus

This is because the company has seen funding costs rise more quickly than asset yields. A significant reason for this is that like most banks, Synovus carries a portfolio of high-quality, fixed income assets, which now sits on a large unrealized loss. The securities portfolio has held flat at $11.175 billion with the yield up just slightly to 2.20% from 2.16%. SNV has stopped growing this portfolio but has been reinvesting maturing principal to hold it flat. Given the bank has an already-high 87% loan-to-deposit ratio, I would prefer SNV use maturities to build liquidity and reduce high-cost brokered deposits, which would likely be NIM-accretive. This would also help to provide some insulation, should there be another deposit crisis.

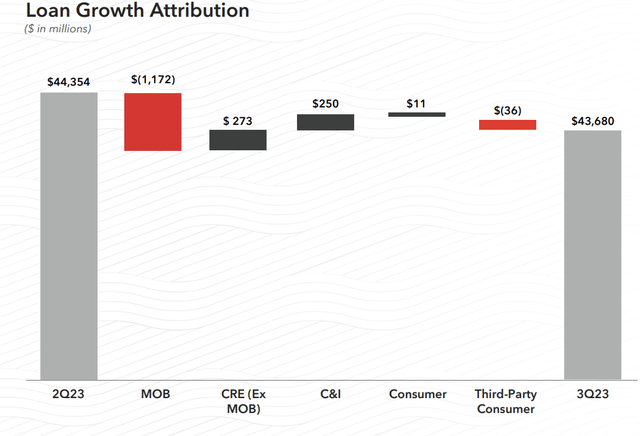

During the quarter, the bank did reduce loan production by 42% from last year, as higher funding costs increase the hurdle rate for attractive lending, though the floating rate nature of loans helps to offset higher deposit rates. Office accounts for 4.4% of loans, from 6.8% last quarter due to the sale of medical office loans in the quarter. Due to this asset sale, loans fell by $700 million during the quarter. Lower loan balances alongside higher deposits do reduce net interest income, all else equal. Adjusting for this sale, there were 0.4% of loan charge-offs in the quarter, a reasonable level.

Synovus

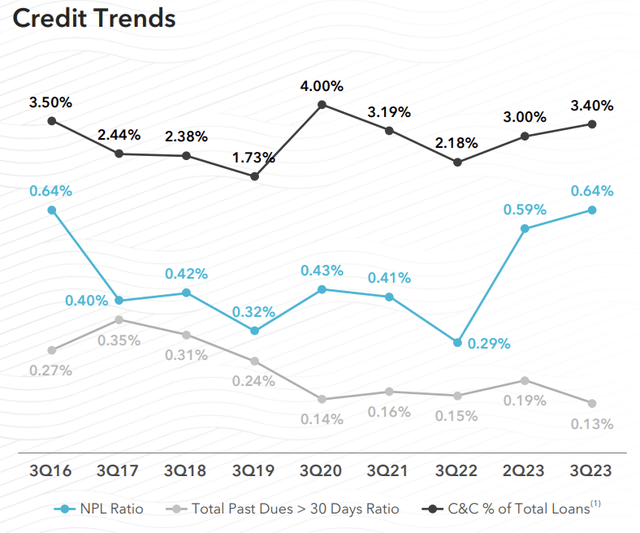

Credit quality is a concern for me. As you can see below, the bank has seen an increase in nonperforming loans (NPL) in recent quarters and we are now at the highest Q3 level in seven years. Given an uncertain economic backdrop, SNV has been building reserves. Allowances for credit losses are now 1.22% of loans from 1.19% previously. This provides under 200% coverage of NPLs, which is below the 250-300% level I view as healthy. To reach the midpoint of my healthy level, SYN would need to take a further $270 million in reserves. If done over a year, that would reduce earnings by $1.38.

Synovus

To be exceedingly clear, that is not a solvency-threatening event. Synovus would remain profitable even after such a reserve build, but it would significantly reduce the bank’s earnings power. Given all of concern about commercial real estate, it is notable that Synovus’s $12.4 billion of commercial real estate loans have just a 0.28% non-performing rate. SNV’s CRE loans are actually performing better than its total loan book, which is quite surprising given the secular pressures here and unusual compared to banks like PNC (PNC) that have much weaker CRE portfolios than their total portfolio.

This leaves me somewhat concerned about further potential losses if Synovus’s CRE portfolio begins to perform like peers. Indeed, adjusted earnings were aided by the fact $31 million of losses associated with its $1 billion in loan sales were excluded, pointing to the fact buyers saw more credit risk relative to their carrying value than Synovus had. Medical office is also generally better than regular office space since medical activities are more likely to require in-person interaction.

Now, on the bright side, its $1.9 billion of office loans have just a 58% loan-to-value ratio, meaning even if many of these 1.46% of NPLs default, actual losses could be small. Still, the combination of a relatively low NPL coverage ratio, rising NPLs, and a loss on loan sales leads me to believe the risk is that Synovus has rising credit costs through 2024.

Elsewhere, non-interest revenue rose by 1% from last year as strength in core banking and wealth were offset by low mortgage volumes. Given where mortgage applications are, mortgage revenue is likely to remain muted. Employment costs rose by 4% from last year but were flat sequentially as the company reduced headcount by 4%. This should lead to slowing noninterest expense, though there will be a one-time $47 million FDIC charge in Q4 to cover the cost of this year’s bailouts of depositors.

Alongside results, Synovus tightened guidance with core deposit growth expected at 1-3% from 1-4% previously, given NIB attrition while noninterest expense growth will be4-5% from 4-6% thanks to recent layoffs.

Tier 1 common equity (CET1) is up to 10.1% from 9.5% last year, above the bank’s 10.0% target. This would seem to enable more shareholder returns, if economic conditions are stable, and it does not grow its balance in 2024. However, I think it is important to emphasize why SNV has been building capital. As noted above, SNV has unrealized losses on its securities portfolio, alongside fixed rate swaps. These losses total $1.7 billion and sit in accumulated other comprehensive income (AOCI). They are not included in CET1 calculations, and because SNV has less than $100 billion in assets, they are unlikely to be. However when included, capital is just 7.1%, right near the regulatory minimum. SNV is not alone in this position, but the bank is carrying extra regulatory capital so that its true economic capital position is reasonable. Now because of the short duration profile and pull of bonds toward par as maturity gets closer, this loss shrinks to $1.3 billion in a year and $1.1 billion at the end of 2025 based on the 9/30 forward curve. Given interest rates are lower today, the losses would likely shrink somewhat faster. Holding all else constant, SNV’s AOCI-inclusive CET1 would be 8.2% at the end of 2025 given the shrinkage of its unrealized loss. This is closer to the 8.5-9% level I would be comfortable seeing SNV operate at, which can be achieved by retaining capital from earnings.

Over the next year as fixed-rate securities and hedges mature and are re-deployed at prevailing rates, NIM can rise by 23bp with the trough occurring in Q4 2023, assuming we do not see a worsening of deposit betas. Assuming about 3% loan growth, that would give SNV about $3.65 in earnings power in 2024, holding credit costs constant. I fear that is likely to be an overly optimistic view, as outlined above. I see about $1.38 in earnings at risk from credit losses. Assuming these reserve builds occur gradually over two years, SNV could earn $2.95-$3.10 in 2024.

That leaves shares with a 10x multiple, towards the higher-end of where regional banks trade. Shares are also trading between its $23.74 tangible book value and its $35.37, tangible book value excluding AOCI. I have argued banks with stable deposits can trade above TBV as they are highly unlikely to realize those AOCI losses. However, there is clearly an economic cost to having bought bonds at 2% in a 5% interest rate world. Giving half-credit for AOCI losses, SNV would be worth $29.55 or just under 10x 2024 earnings. That is essentially where shares are trading today. Investors can collect a 5% yield, but I see limited upside given my credit concerns. Given the opportunities in this beaten-up sector, I believe investors should rotate out of SNV into banks like Comerica (CMA) or Huntington (HBAN).

Read the full article here