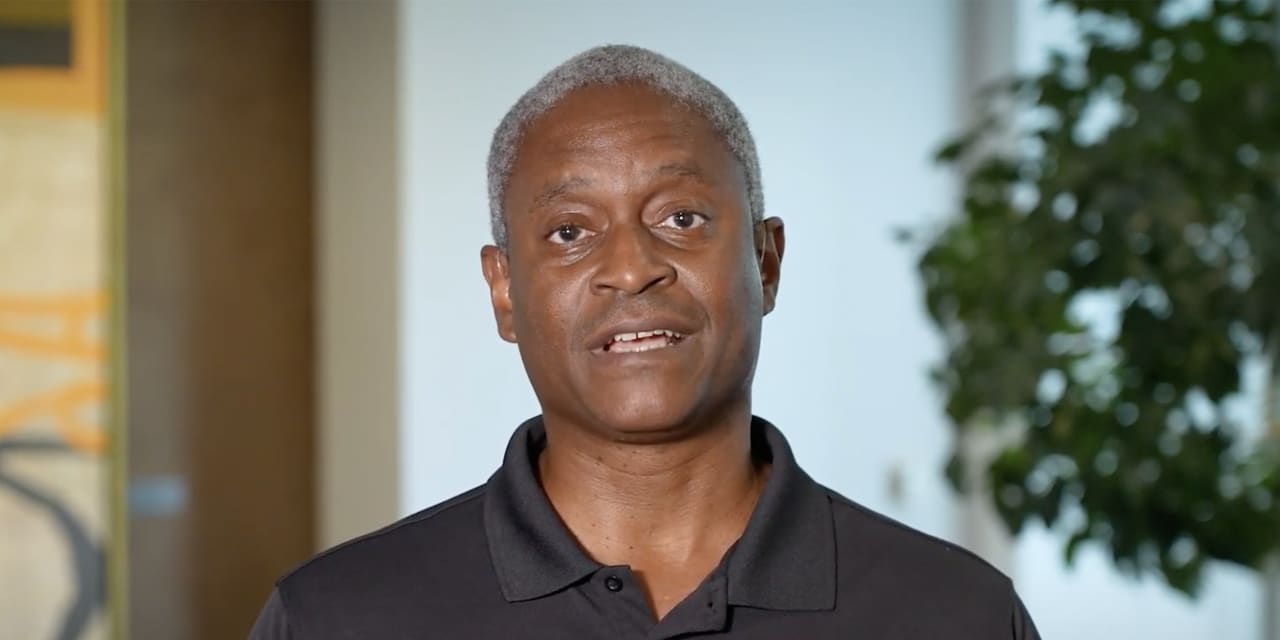

Atlanta Fed President Raphael Bostic said Wednesday that he is more confident in his forecast of a soft landing for the U.S. economy.

“I think inflation keeps falling,” Bostic wrote in an essay on the outlook posted on his regional bank’s website.

At the same time, businesses in the Atlanta Fed’s district think the economy will slow “but not dramatically enough to portend a destructive economic downturn.”

The staff at the Atlanta Fed is expecting U.S. economic growth to slow to a 2% annual rate in the fourth quarter from the 5.2% rate in the July-September period. Growth next year will be “just above 1%” in all of 2024.

Inflation will soften to a 2.5% rate by the end of 2024 and “closer to 2% by 2025, according to the staff forecast.

There is still a ways to go to get to the Fed’s target, Bostic said, and progress may be bumpy.

The unemployment rate is expected to tick up only to 4%, keeping it mostly in line with where it’s been since 2018 — excluding the spike caused by COVID-19 from March 2020 to early 2022.

“While I always view economic projections with a healthy degree of caution — especially in these times of heightened uncertainty — I believe we can feel more confident in the outlook just now,” Bostic said.

One reason for confidence is the reliability of his regional bank’s surveys, Bostic said.

Recently, Bostic said his staff has picked up signs that companies are losing the ability to raise prices that they had gained during the pandemic. That is a key driver of inflation.

Bostic will be a voting member of the Fed’s interest-rate committee next year.

The 10-year Treasury yield

BX:TMUBMUSD10Y

has fallen to 4.26% as markets are betting that the Fed will start to cut interest rates in the first half of next year.

Read the full article here