Note: Investors should view this article as an update to my previous coverage of BW LPG, where I commented on their Q3 2023 report.

Investment Thesis

BW LPG Limited (NYSE:BWLP) (OTCPK:BWLLY) just reported Q2 earnings:

- EPS of $0.58 ($0.59 in Q2 last year, -1.6%).

- TCE per available day was $49,660 ($52,500, -5.4%).

- it declared a $0.58 quarterly dividend ($0.81, -28%).

The market responded by adjusting BW’s stock price down by 1.8%.

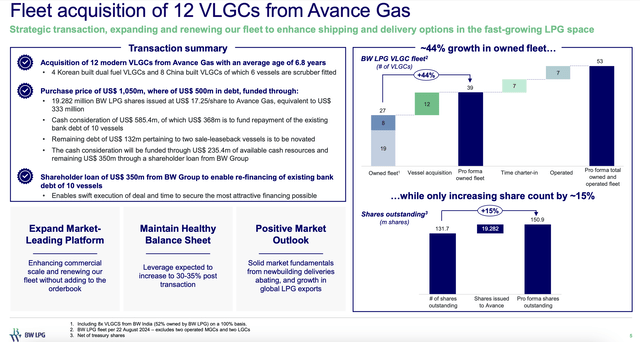

BWLP made waves recently by acquiring peer Avance Gas’ (OTCPK:AVACF) fleet of 12 VLGCs in a deal that will result in AVACF owning 12.77 percent of BWLP. With a world fleet of about 370 VLGCs, BWLP will own or operate one in eight ships on water. Since the announcement, AVACF and BWLP have been down 27% and 5%, respectively.

The LPG transportation trade has had a few stellar years, with each listed alternative delivering dividend yields in the double digits and excellent total returns. However, there have been signs that this adventure might be tapering off.

In its report, BWLP said it had fixed 86 percent of available days for Q3 at $43,000/day. For comparison, its realized TCE in Q3 2023 was $63,100 per available day-46% higher than its current booking for this Q3. However, $43,000 is still well above its cash breakeven point, and it should also be able to pay attractive dividends in Q3 and beyond due to the favorable market outlook. It trades at what the author estimates is close to NAV, leaving limited upside, but still presents as an attractive option for dividend investors. I will look to add to my dividend portfolio, where I am already long BWLP.

A Brief Overview of BW LPG

BW LPG is the largest listed owner-operator of VLGCs, currently controlling a fleet of 42 ships. It is dual-listed on the NYSE and Oslo Stock Exchange and domiciled in Singapore (no dividend withholding tax).

Over the years, it has grown into a more integrated transportation and logistics company, with a product services (trading) division currently accounting for about 15 percent of gross profits. In late 2023, it also ventured into import terminals in India. In any case, LPG shipping through its VLGC fleet remains the largest segment of its business.

How Does the Acquisition Deal Affect BW LPG?

The slide below, taken from BW’s earnings presentation, contains much information we’ll need to dissect.

Fleet acquisition deal overview (Q2 earnings report)

Let’s first consider the positives.

Fleet renewal. Pre-deal, BW LPG’s fleet had an average age of 10 years (according to its fleet list). 16 of its 41 VLGCs were compliant fuel only. Compared to AVACF’s 6.8-year-old fleet and peer Dorian LPG’s (LPG) nine-year-old fleet. BW LPG was lagging. With the increasing availability of, and to some extent, expectation and requirement to use, alternative fuels and increased efficiency, it would have to do something. With long delivery times for newbuilds and high asset prices, the opportunity to take over AVACF’s fleet seems good.

Increased scale. One of the issues facing a small owner-operator like AVACF is scale. It’s easier to create economies of scale with a larger fleet. Post-deal, assuming no sales, BWLP’s fleet will exceed 50 VLGCs.

Then, let’s look at the negatives.

Increased leverage. BWLP has had the lowest leverage ratio in its history, but the deal will increase it to 30-35 percent. Its remaining close peer, Dorian, had about 17 percent net leverage as of June 30. Still, in an asset-heavy industry like shipping, 35 percent leverage is low by historical standards.

Shareholder dilution. BW LPG will issue 19 million shares to finance the deal partially, representing a 15 percent increase in outstanding shares.

In summary, BW LPG found a quick way to expand its fleet at a reasonable price, given today’s asset prices and ship availability. However, it does so at the expense of increased leverage and shareholder dilution.

Would 12 Additional Ships Bring in Enough Profits to Offset the Dilution?

Let’s run a simplified simulation to understand if the increased profits would offset the dilution.

15% additional outstanding shares would decrease DPS to about $0.51 (about a 12 percent decrease), assuming everything else is equal. That’s because the $76.4 million it will pay out in dividends would be shared among 150.9 million shares and not 131.7 million.

Assuming those additional 12 ships would be operating for BW LPG in the quarter, they would generate $48,000 in TCE income per calendar day (as its Q2 report stated was the TCE equivalent). In other words, they would bring in 12 * 90 * 48,000 = $51 million.

Operating expenses would be $8,600 per ship per day (p. 13 in the Q2 earnings report), totaling $9.3 million: 8,600 * 12 * 90 = $9.3 million.

Depreciation is assumed to be as follows: 12 new ships for $1,050 million mean an average cost of $87.5 million per ship. Assuming a useful remaining life of 20 years, that would be $1 million per quarter (87.5 million/20 years/4 quarters), or $12 million in total.

Interest expense would also increase. The deal will be part-financed with a $350 million shareholder loan from the BW Group and a novation of $132 million related to the sale-leaseback ships from AVACF, meaning that debt would increase by about $482 million. Assuming an effective interest rate of 3%, it would amount to $4 million per quarter.

So, with these assumptions, we get the following calculation:

| TCE income | 51 |

| – OPEX | 9 |

| – Depreciation | 12 |

| – Interest expense | 4 |

| = Contribution to net profit | 26 |

That brings us to the following side-by-side comparison:

| Pre-deal | Post-deal | ||

| Declared dividends (million $) | 76.4 | 102.4 | |

| Outstanding shares (million) | 131.7 | 150.9 | |

| DPS per share ($) | 0.58 | 0.68 |

In conclusion, the addition of 12 ships would be a net positive. However, I’d like to point out that these assumptions may be incorrect and that the calculation is simplified. It also assumes that all ships would be average on the same commercial terms as the rest of the fleet. For context, just one ship out on dry docking (for 30 days) would reduce revenues by more than $1 million, lowering DPS to 0.67 in the calculation above.

In other words, the acquisition could be positive in the short term. In the long term, it likely will, as BW LPG’s fleet gets a much-needed renewal and economies of scale increase.

Market Outlook

The LPG marine transportation market depends on the capacity and willingness of large producers (the U.S. and Middle East) to export, as well as the ability of large Asian markets (China, India, Japan) to import. Additionally, changes to the world fleet of VLGCs are, of course, central.

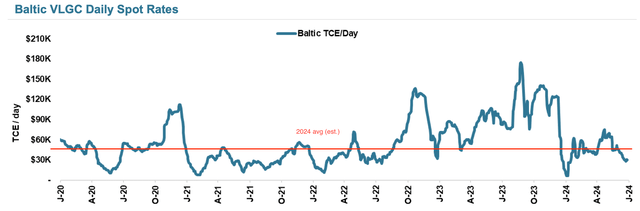

First, let’s put this year in context in terms of rates, using a graph borrowed from Dorian LPG’s latest investor presentation and annotated by the author:

Baltic TCE/day rates, 2020-2024 (Dorian LPG August investor presentation, annotated by the author)

The red line is an estimate of the 2024 average. It shows that while most of 2022 and 2023 were significantly better, 2024 is comparable to 2020 and better than 2021.

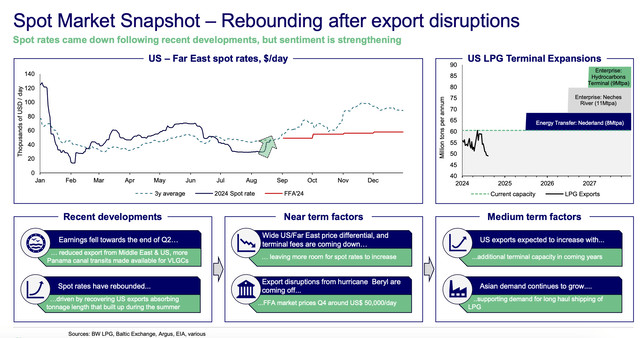

This slide provides a more accurate picture. The forward curve supports rates in line with the 3-year average, or slightly below for the entire year.

Spot rates and export capacity expansion (Q2 earnings presentation)

Also, the increase in export capacity in the U.S. will support increased demand in its target markets.

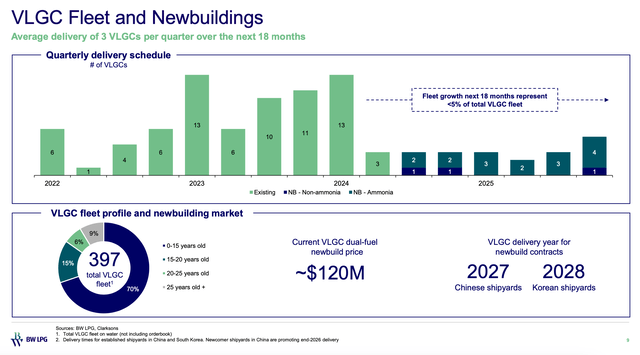

Pressure From Newbuilds Coming on Water Dissipates

2023 and 2024 saw both high rates and many new ships coming to water. For the next few years, significantly fewer vessels will be added to the global fleet:

Fleet and newbuilds (Q2 earnings presentation)

Fifteen percent of the fleet is at least 20 years old (candidates for scrapping), which means the global demand is approaching balance.

Robust Demand in Important Markets

Dorian LPG’s August investor presentation shares forecasts for Chinese and Indian LPG demand. Chinese demand is driven by petchem demand, while Indian policies support retail demand for LPG. Both Indian and Chinese imports have increased 12% YTD compared to 2023.

Valuation

With rates lower than and likely to remain lower than the fantastic year of 2023 and an acquisition deal that will dilute shareholders – is there an upside to BW LPG’s current share price?

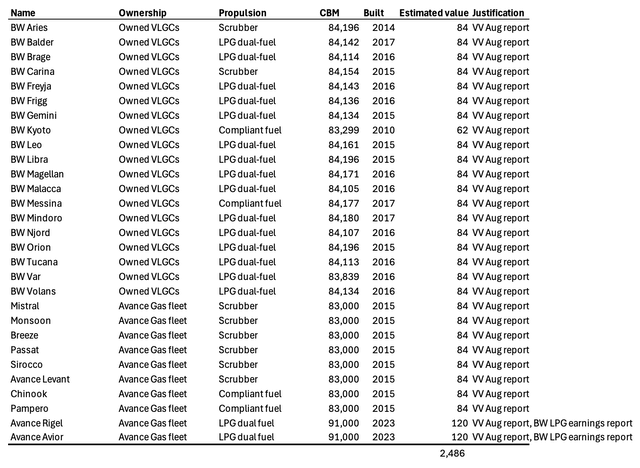

To estimate the value of its owned fleet, plus the incoming Avance Gas ships (less the two sale-and-leaseback ships), I applied Vessels Value’s latest monthly report:

Estimated value of BW LPG’s owned fleet (Author’s calculations based on BW LPG fleet list, Avance Gas fleet list, VesselsValue July report)

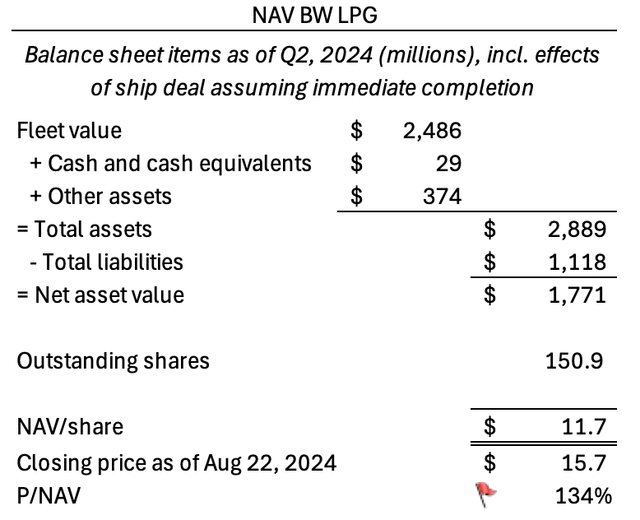

Furthermore, by estimating NAV, we arrive at the following:

NAV calculation BW LPG (Author’s estimates based on Q2 earnings report)

In this calculation, the following assumptions have been made:

- Cash: As reported at end of Q2 less cash consideration in the deal: 264 – 235 = 29

- Other assets: Total assets as of Q2 less PPE and cash

- Total liabilities: Reported total liabilities plus shareholder loan from BW group and novation of $132 million

- Outstanding shares after the deal has closed (19 million shares issued to Avance Gas)

Additionally, this calculation does not take into account the profit potential of its trading division, as it focuses on asset value. Above, we discovered that the trading division accounted for 15 percent of gross profit. Simply assuming that the trading division accounts for 15 percent of EPS (amounting to $0.58 * 0.15 = 0.087) and multiplying this by four quarters, we arrive at $0.348 annually. Assuming the division can be priced at 5 to 15 times EPS, it would add $1.7-$5.2 to the value per share. In other words, BW LPG is likely trading at close to NAV.

Conclusion

This article has taken an in-depth look at the effects of the recent deal to acquire Avance Gas’s VLGC fleet in the context of BW LPG’s recent earnings report. While the VLGC market has tapered off slightly from the boom years of late 2022 and 2023, rates still support attractive dividend yields and the market outlook is favourable. The global fleet is expected to grow slowly in the coming years, while the export capacity of the major producers is set to increase. BW LPG is still an attractive option for income investors, but the heydays are gone – at least for this time.

Read the full article here