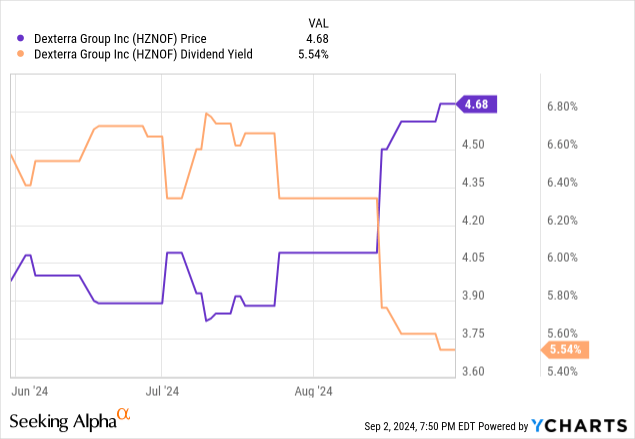

Dexterra (OTCPK:HZNOF) continued to meet its strategic objectives by shedding assets in the second quarter. The firm also reported quarterly earnings and revenue growth. The results, along with stronger stock market conditions, sent HZNOF stock from below $4.00 to around $4.69 at the time of writing.

Dexterra reported operational improvements that demonstrate that the firm is meeting its business plan objectives. That includes strong results, continued support services growth, and higher margins.

Q2/2024 Results

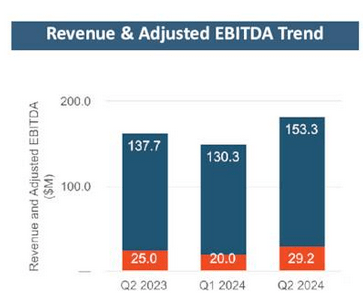

In the second quarter, Dexterra posted Q2 revenue of $253.6 million. This increased by 18.1% compared to last year. The company benefited primarily from strong natural resource market activity levels in WAFES (Workforce Accommodations, Forestry & Energy Services). WAFES is one of two operating business units. IFM, or Integrated Facilities Management, is the second unit. Revenue increased as a result of growth in IFM. WAFES performed well thanks to strong camp occupancy and asset utilization.

Dexterra’s quarter benefited from the onboarding of new large contracts. This replaced the completed projects.

Dexterra

Readers should note that the company included a full quarter of the CMI Management LLC acquisition in its results.

Balance Sheet Strengthened

On July 2, 2024, Dexterra announced the closing of the asset sale of 329 space rental units. The $20.45 million sale gives the firm the chance to pay down its debt. At the end of the quarter, the company ended with $139.8 million in debt. Debt increased sequentially from $132.7 million in Q1. However, the increase was due to normal business seasonality.

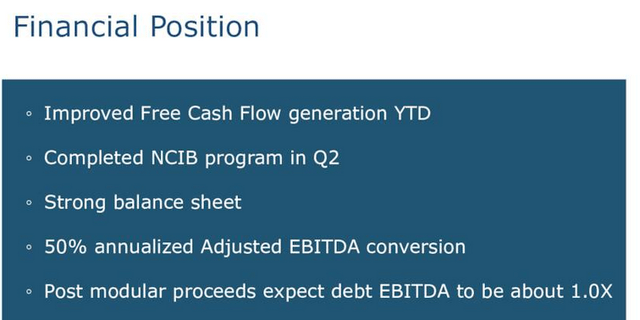

Free cash flow was $10.1 million. This improved after the company achieved strong collections of receivables during the quarter. In Q3 and Q4, Dexterra expects an adjusted EBITDA to FCF conversion of 50%. Since it anticipates seasonal strength in its WAFES and IFM units, shareholders should expect cash levels to increase by the end of the fiscal year.

In its Q2 presentation, Dexterra highlighted the FCF generation and the completion of the stock buyback as shown below:

Dexterra

The 1.0 times debt-to-EBITDA target ratio is the key takeaway from the above slide. In the near term, the company will keep its debt ratio below two times. It will have a chance to buy back stock to increase shareholder returns. In addition, it will use the excess cash to acquire niche businesses.

Shareholders will look forward to the company paying a $0.0875 a share dividend to shareholders of record on September 30, 2024.

Opportunities

Dexterra has acquisition targets that expand its geographical addressable markets. Chief Executive Officer Mark Becker said that the company seeks acquisitions that strategically fit IFM opportunities. He is looking for capabilities in Canada and the U.S. that are small in size. This would lower the risk of straining the balance sheet.

Even though the Federal Reserve and Bank of Canada plan to cut interest rates, shareholders would prefer that Dexterra continue to pay down its debt.

The company has an asset-light business strategy. Investors may expect that Dexterra will continue to expand its operating margins. For example, the company divested the LNG Canada space rental assets. It will look for assets that offer quick short-term payback.

Dexterra spent up to 1.5% of its revenue on capital spending year-to-date. It plans to allocate that spending to opportunities that support its long-term client base. This includes things like fleet support and access matting for customers on long-cycle contracts.

CEO Becker said that it spent $10 million on those items. Those will continue to have high payback in the form of margins and high returns from those opportunities.

Risks

Demand for facilities may weaken. For example, lower fire activity hurt demand from the forestry business. Still, WAFES activity benefited from strong asset utilization. The energy space and mining are some of Canada’s sectors that drove higher usage.

Energy prices might hurt demand. However, Dexterra benefited from providing long-term operational support in the oil sands sector. Furthermore, the company won new large long-term contracts in Q1. This came on stream in the second quarter, replacing its Coastal Gas Link and LNG Canada projects.

Your Takeaway

Dexterra sold assets to improve its balance sheet and lower debt. It continues to execute its business plan. Shareholders appreciate the company’s predictable results and improved profitability.

The company’s share price is somewhat range-bound. Once the company announces small acquisitions that increase its addressable market and add meaningfully to its profitability, investors will recognize the stock’s potential.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here