Dorchester Minerals’ (NASDAQ:DMLP) Q2 2024 results were largely in line with my expectations. Dorchester’s Q2 2024 oil sales volumes rebounded 7% from Q1 2024 levels, while its distribution ended up at $0.702058 per common unit.

This distribution was approximately $0.08 per unit lower than its Q1 2024 distribution, but that previous quarter benefited from a significant amount ($4 million) of cash receipts from its new acquisition that were independent of sales volumes. This was due to the acquisition closing near the end of Q1 2024, but Dorchester receiving cash receipts for the full quarter.

Without that acquisition, Dorchester’s Q1 2024 and Q2 2024 distributions would have been similar, and I currently expect Dorchester’s 2H 2024 distributions to average around $0.70 per unit (per quarter) as well. Although Dorchester’s results were in line with my expectations, I have increased its estimated value slightly to a bit over $33 per unit (compared to $32 before). This reflects a roughly 9% distribution yield at my long-term commodity price estimates. Dorchester’s units should become more attractive for their relatively high yield with the expectations for a lower interest rate environment.

Q2 2024 Results

Dorchester’s natural gas sales volumes (both royalty and NPI) were roughly stable quarter-over-quarter, while its oil sales volumes increased by 7% quarter-over-quarter. Dorchester’s royalty oil sales volumes increased, while its NPI oil sales volumes decreased. Dorchester’s Q2 2024 sales volumes were more in line with my baseline expectations than Q1 2024, which saw a dip in oil sales volumes.

| Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 | Q2 2024 | |

| Royalty natural gas sales (mmcf) | 1,330 | 1,153 | 1,344 | 1,283 | 1,268 | 1,275 |

| Royalty oil sales (mbbls) | 302 | 335 | 477 | 404 | 343 | 423 |

| NPI natural gas sales (mmcf) | 864 | 475 | 412 | 550 | 489 | 493 |

| NPI oil sales (mbbls) | 269 | 158 | 135 | 178 | 176 | 131 |

Dorchester realized only $1.71 per Mcf for its natural gas (combined royalty and NPI), although that was slightly higher than its realized price from Q1 2024.

Strong benchmark oil prices allowed it to realize $70.04 per barrel for its oil in Q2 2024, approximately 85% of WTI during the quarter. Dorchester’s reported oil sales volumes include some volumes attributable to NGLs, so that brings down its reported realized price for oil. Dorchester had oil PDP reserves that were around four times its NGLs PDP reserves (based on barrels) at the end of 2023.

Dorchester’s Q2 2024 sales volumes were 65% oil (including NGLs), but oil contributed over 90% of its revenues with natural gas prices being relatively weak.

Estimated 2H 2024 Distributions

Based on current strip prices and assuming flat sales volumes compared to Q2 2024, I now estimate Dorchester’s distributions to average around $0.70 per unit for the last two quarters of the year.

Dorchester’s Q3 2024 distribution may be in the $0.70 to $0.75 per unit range, and its Q4 2024 distribution may be in the $0.65 to $0.70 per unit range based on the strip. The oil strip for Q4 2024 is several dollars lower than Q3 2024.

Notes On Valuation

Dorchester’s sales volume levels for Q2 2024 met my expectations. If Dorchester’s sales volumes remain unchanged (compared to Q2 2024), it should be able to average a $0.75 per unit quarterly distribution at my long-term commodity prices of $75 WTI oil and $3.75 Henry Hub natural gas.

My long-term commodity price estimates haven’t changed recently, although it should be noted that strip prices are now a bit below my long-term commodity price estimates.

A $3 per unit annualized distribution would make Dorchester worth slightly over $33 per unit at a 9% distribution yield.

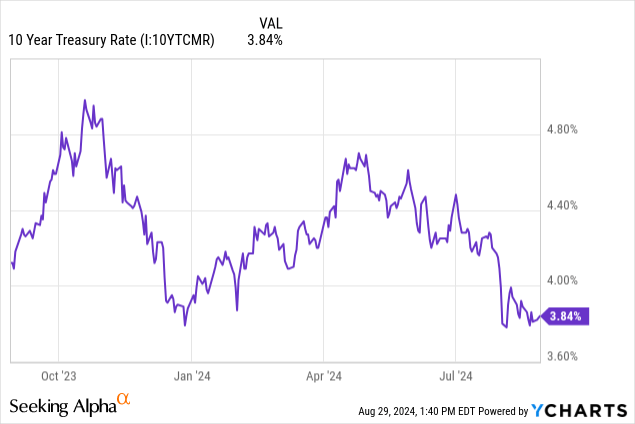

I had been valuing Dorchester based on a 9.5% distribution yield before, but Treasury yields have gone down a bit since then. For example, the 10 Year Treasury rate reached 5% in October 2023 but is now down to 3.84%.

Similarly, the 1 Year Treasury Rate has gone down to around 4.41% now, compared to approximately 1% higher in October 2023.

A lower interest rate environment should make Dorchester’s units more attractive to those hunting for yield.

Conclusion

Dorchester’s Q2 2024 oil sales volumes increased 7% from Q1 2024 levels, although its Q2 2024 distribution was lower than its Q1 2024 distribution due to the timing of cash receipts and less of a boost from its Q1 2024 acquisition.

Overall, Dorchester’s sales volumes were in line with my expectations, and I’d expect its Q3 2024 and Q4 2024 distributions to average approximately $0.70 per unit as well based on current strip prices.

At my long-term commodity prices of $75 WTI oil and $3.75 Henry Hub natural gas, I’d expect Dorchester to generate around $0.75 per unit in quarterly distributions on average.

This should support an estimated value of a bit over $33 per unit at a 9% distribution yield. If interest rates continue to decline, Dorchester’s units should become more attractive for their yield.

Read the full article here