By Bob Iaccino

At a Glance

- The final trading session before the annual Russell Reconstitution is typically one of the most active days of the year

- By migrating portfolio stock positions to futures, traders can streamline operations and better control tracking error related to the reconstitution

Every June, the U.S. equity market undergoes one of its most significant and closely-watched events: the annual Russell Reconstitution. Managed by FTSE Russell, this process realigns the membership of its widely-followed equity indexes – including the Russell 1000, Russell 2000, Russell 3000 and the Russell Microcap – to reflect changes in the market capitalization and structure of publicly traded U.S. companies. The reconstitution is a highly anticipated moment for traders, fund managers and companies, and can have profound implications for stock liquidity, visibility and performance.

The Russell Reconstitution ensures that the indexes represent the current U.S. equity market landscape. Each index plays a crucial role in the investment world:

- Russell 1000: Captures large-cap stocks.

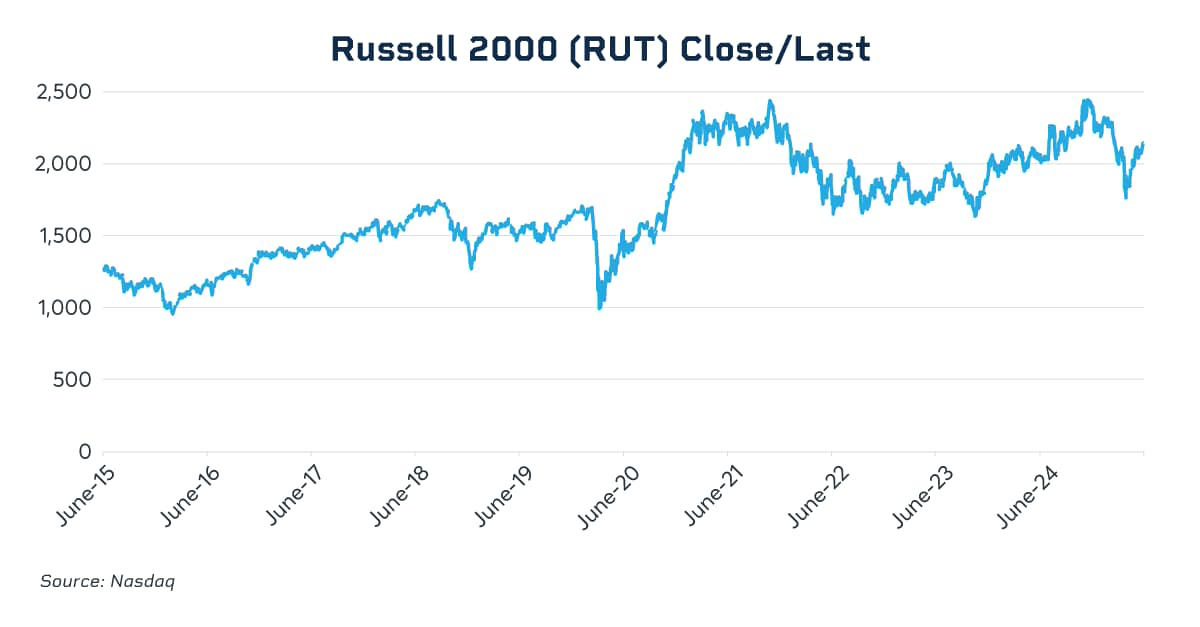

- Russell 2000: Focuses on small-cap stocks.

- Russell 3000: Represents the broad market.

- Russell Microcap: Includes the smallest publicly traded companies.

When companies move among these indexes, or are added or removed entirely, billions of dollars in passive index-tracking funds must adjust their holdings to reflect the changes. Inclusion in a Russell index often boosts a company’s market visibility and institutional ownership. Conversely, deletion from the index can result in reduced visibility and potentially lower demand for a company’s shares. This adjustment in large investor behavior often drives increased volatility and trading activity around the reconstitution date.

Key Dates

- Rank Day: April 30, 2025. On this day, FTSE Russell ranks all eligible U.S. stocks by their total market capitalization, using data as of the market close. This ranking determines potential index membership for the upcoming reconstitution.

- Preliminary List Publication: May 24, 2025. The preliminary list of additions and deletions is published after the market closes. Updated versions of these lists are released weekly until the final changes are locked in.

- Official Lockdown Period: June 9, 2025. Membership changes are considered final, barring any extreme market anomalies.

- Reconstitution Effective Date: June 27, 2025. The actual reconstitution takes effect after the market closes.

- New Trading Begins: June 30, 2025. Trading starts with the newly rebalanced Russell indexes.

Trading Around the Reconstitution

The weeks leading up to the final reconstitution date often see outsized volume and price action in stocks affected by the changes.

Index funds and institutional managers often begin trading before the official adjustment to minimize “tracking error,” or the difference between the returns of an index fund and the returns of the index that the fund is trying to match. Meanwhile, traders and hedge funds may also look to capitalize on inefficiencies or arbitrage opportunities created by forced buying or selling.

The final trading session before the reconstitution, which falls on June 27 this year, is typically one of the highest-volume days of the year for U.S. stocks. During the last hour of that session, known as the “closing auction,” trillions of dollars may shift across portfolios as fund managers execute trades to align with the new index compositions. This makes execution risk especially high, particularly for managers trying to track the index while managing slippage and liquidity impact.

One strategy to navigate this window is using CME Group’s suite of FTSE Russell Index futures and options. These contracts allow investors to gain or reduce exposure in a capital-efficient manner, without needing to transact in the underlying cash equities subject to reconstitution flows. By moving into a futures position, fund managers and traders can avoid the operational complexity of executing hundreds of small-cap trades and the tracking error that can accompany rapid portfolio adjustments, and Basis Trade at Index Close (BTIC) and Exchange for Related Positions (EFRPs) trades offer an even more seamless way to achieve this. The futures market’s deep liquidity, especially around the reconstitution window, makes it a practical tool for those seeking flexibility, precision and efficient execution.

Upcoming Structural Shift in 2026

In a major departure from tradition, FTSE Russell announced plans to transition to a semi-annual reconstitution schedule starting in 2026. Instead of one major reshuffle in June, the indexes will now be updated twice a year – once in June and again in November. This change is designed to more accurately reflect the rapid evolution of the equity markets and reduce the distortive impact of a single annual adjustment.

This move may also ease some of the trading volatility traditionally associated with the June reconstitution, as index-related adjustments will now be more evenly distributed throughout the year. However, it will require fund managers to remain nimble and adjust their internal processes for index-linked strategies.

Retail investors should be aware that stock price movements around this time are often not driven by company fundamentals, but by rebalancing flows. One effective way to manage the resulting short-term volatility risk is through the Micro E-mini Russell 2000 futures contract from CME Group, which offers precision exposure in navigating the reconstitution window.

The 2025 Russell Reconstitution remains an important event on a trader’s calendar. It not only reshapes the index, but can also temporarily alter the behavior of markets and investors. With billions of dollars in assets being reallocated, the reconstitution can generate significant volatility, risk and opportunity. Understanding the mechanics and impact of this process is essential for market participants involved in U.S. stock indexes.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here