If there was any great lesson in life it was this: No battle was ever won with silence.” – Shannon L. Alder

Today, we are revisiting Lightspeed Commerce (NYSE:LSPD) for the first time since late 2022. We concluded that the article said the company has gotten much cheaper than when we first looked at it in the first quarter of 2022 and Lightspeed had a rock-solid balance sheet. That said, the company was too far away from profitability to be investable at that time. The shares are trading a bit higher than back last December and the company posted better than expected quarterly results earlier this month. We follow up on Lightspeed Commerce below.

Seeking Alpha

Company Overview:

This small cap SaaS concern is located in Montreal, Canada. Lightspeed provides cloud-based software subscriptions and payments solutions that enable small and midsize businesses including retailers, restaurants, and golf course operators to engage with their customers to manage operations, accept payments, etc. The stock currently trades around $16.50 a share and sports an approximate market capitalization of $2.5 billion. The company’s fiscal year starts on April 1st.

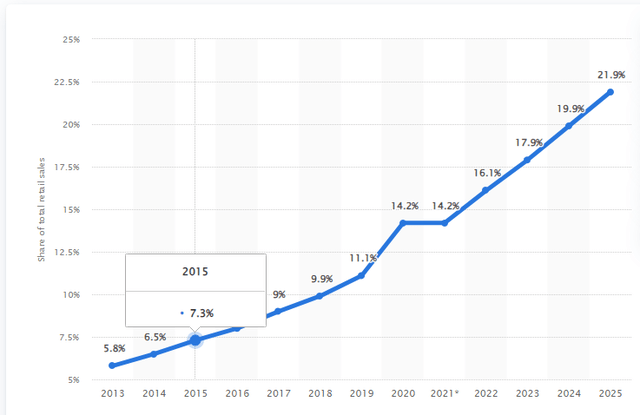

Online Retail Sales (Percent of overall retail) (Statista)

The omni-channel commerce provider is benefiting from the continued shift from legacy point of sale or POS systems to integrated and SaaS-based solutions. Lightspeed is also the beneficiary of growth of retail sales which are approaching 20% of all retail transactions. The company’s main sources of revenue are from subscriptions as well as a percent of payment transactions coming across its platforms. They also get a very small percent of revenues (roughly 5%) from hardware and other services. The company has made nine small acquisitions in recent years to rapidly integrate new capabilities into its product portfolio.

Second Quarter Results:

Lightspeed Commerce posted its second quarter numbers on November 2nd. The company delivered a non-GAAP profit of four cents a share. Expectations were for a two-cent loss. Revenues rose just over 25% on a year-over-year basis to $230.3 million, more than $15 million above the consensus. Leadership had previously issued guidance calling for between $210 million to $215 million of revenue in the quarter. Gross payment volumes or GPV grew 59% from the same period a year ago to $5.9 billion. Transaction based volume grew 36% year-over-year to $137.7 million. Subscription revenue rose nine percent to $81 million for the quarter.

Adjusted EBITDA came in at $200,000, above previous guidance of a negative $4 million and that of a negative $8.5 million in 2Q2023. Average revenue per user or ARPU rose 26% from the same period a year ago to $425. Management provided revenue guidance of $890 million to $905 million, roughly in line with the analyst firm consensus at the time.

Analyst Commentary & Balance Sheet:

Since third quarter results were posted, four analyst firms including RBC Capital and Barclays have reissued Buy ratings. Price targets proffered range from $19 to $25 a share. CIBC ($17.50 price target) and Piper Sandler have maintained their Hold ratings on the equity, however.

Lightspeed exited the quarter with just over $760 million in cash and marketable securities on its balance sheet. The firm has no long-term debt.

Verdict:

Lightspeed Commerce lost 17 cents a share on just over $730 million of revenues in FY2023. The current analyst firm consensus has the company making 13 cents per share in FY2024 as sales rise to just over $905 million. In FY2025, they see a 40 cent a share profit on revenues of $1.15 billion.

The company has made some notable progress since we last looked at it. Lightspeed continues to churn out impressive sales growth and its cash burn rate has come down dramatically. It has maintained its rock-solid balance sheet and profitability seems right around the corner.

A recession in 2024 would be problematic for the company’s small business base and the stock sells for just north of 40 times FY2025’s projected earnings. Therefore, I would not chase the recent rally in the shares. However, if the stock came down below the $15 level, I would likely initiate a starter position in LSPD via covered call orders. Lightspeed is definitely a name to keep an eye on.

You can’t really know what you are made of until you are tested.” – O. R. Melling

Read the full article here