By Samuel Rines

Welcome to the latest installment of the Navigating Earnings Season blog series. In this series, I dive into the world of earnings reports from major companies, spanning giants like JPMorgan (JPM) and Pepsi (PEP), as well as niche players in various sectors. As the earnings season unfolds, these corporate outlooks offer real-world insights that often contrast sharply with the uncertainty emanating from the Federal Open Market Committee (FOMC).

It is called “Camp Kotok.” Every year, a group of people are invited to Leen’s Lodge in Grand Lake Stream, Maine. It is – to put it mildly – the absolute middle of nowhere. Cell service? Poor. Conversations? Amazing. While the gathering is known predominately for its significant lean toward monetary policy discussions and investment squabbles, those assembled are not universally interested in those topics. Some, not even remotely so.

And – to be clear – that is part of the reason the gathering is so fun. From playing games about perception versus reality on the car ride there to digging deeply into the construction of frameworks, it is a unique place for learning.

The car ride was only the beginning. There were four more days/nights filled with other people’s insights. But the car ride discussion was one of the more important because it struck a certain chord. At its core, the game is what this series attempts to do: separate the perceptions from the realities. (This is a good time to read the above link for some context.)

For example, there is a temptation to use broad generalizations in the macro context. These include (but are not limited to) “Europe is performing poorly,” “the consumer is under pressure,” “inflation is over” and “inflation is sticky.” While the statements sound intellectually authoritative, the lack of context renders them rather meaningless. Many times, they are perceptions, not realities.

Tapestry (TPR)

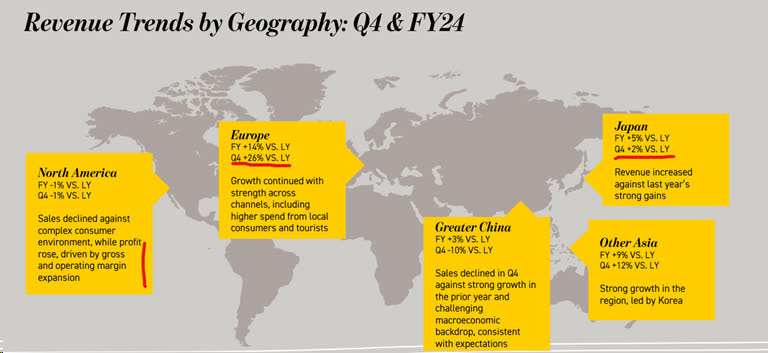

Source: Tapestry, Inc. Q4 investor presentation, 8/15/24 (emphasis added).

For example, Tapestry – owner of brands Coach and Kate Spade, among others – creates a bit of a problem for the perceptions above. In Europe, locals and tourists bought more stuff and a lot of it. Granted, the Paris Olympics might have helped, as their fiscal Q4 is calendar Q2. But that was sponsored by a pseudo-competitor in LVMH. The U.S.? That was not so great.

Walmart (WMT)

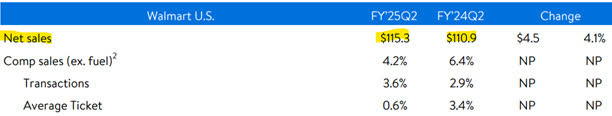

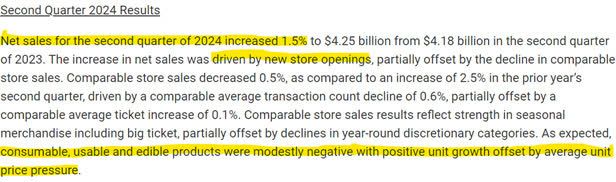

Source: Walmart second quarter press release, 8/15/24 (emphasis added).

As a check, Walmart saw decent numbers. The comp store sales were not quite as good as last year in the U.S., but 4.2% is nothing to sneeze at. There is a legitimate critique here that consumers could be “trading down” from more expensive retailers to Walmart.

That concern is not unwarranted.

Amazon (AMZN)

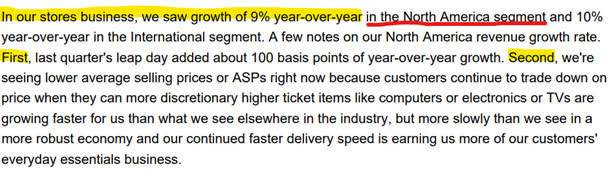

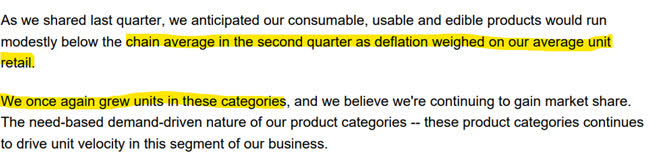

Source: Amazon Q2 2024 earnings call, 8/1/24 (emphasis added).

Parsing Amazon is a bit tricky. Amazon is gaining share and, therefore, less susceptible to the vagaries of the U.S. consumers’ preference shifts. But even Amazon found it necessary to point out the “trade down on price” dynamic. That is meaningful. The consumer is being pressured into spending at Amazon.

Hilton (HLT)

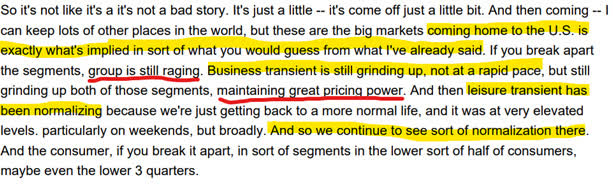

Source: Hilton Q2 2024 earnings call, 8/7/24 (emphasis added).

That must mean there is something more sinister occurring under the surface. From Hilton’s perspective, that does not seem to be the case. While in-person group meetings are “raging,” the leisure side has simply seen a “normalization.” Why? Getting back to normal life.

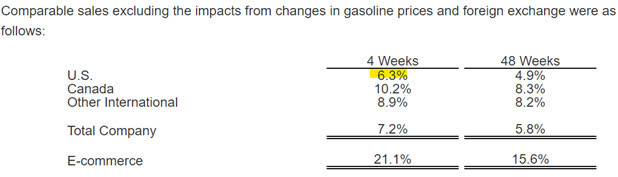

Costco (COST)

Source: Costco July sales results, 8/7/24 (emphasis added).

For the month of July, Costco did not see a material slowing in spend either, with comparable store sales of 6.3% ex-gasoline and foreign exchange. If Walmart skews toward the lower-income consumer, Costco skews toward the higher-income consumer. It is difficult to see the cracks in the consumer when the “big 3” are growing sales this quickly.

Tractor Supply (TSCO)

Source: Tractor Supply second quarter 2024 results, 7/25/24 (emphasis added). Source: Tractor Supply Q2 2024 earnings call, 7/25/24 (emphasis added).

Notably, Tractor Supply said the quiet thing out loud – deflation is good for the consumer and sales volumes but (potentially) bad for revenues. That is not a common refrain being heard from the broader retail community. But it is not something to be ignored, either. There would be consequences.

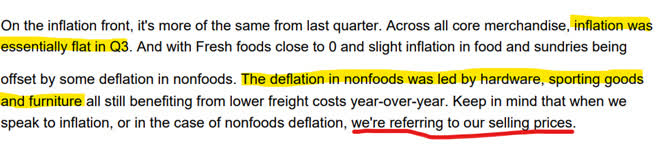

Costco

Source: Costco Q3 2024 earnings call, 5/30/24 (emphasis added).

Costco may have said it best. There was “essentially” no overall inflation of their selling prices, but there were pockets moving in both directions. The potato chips might be more expensive, but the soccer ball is cheaper.

That is part of the reason the reality of earnings calls and commentary is important for breaking the perception of economic narratives (or, just as importantly, reinforcing them). The context of “the U.S. consumer is pressured” matters. The same goes for inflation. The reality leads to much different outcomes and recommendations than the perceptions do.

Already looking forward to the next car ride.

Samuel Rines, Macro Strategist, Model Portfolios

Sam Rines serves as a Macro Strategist, Model Portfolios at WisdomTree extending the firm’s custom model portfolio management capabilities. Prior to WisdomTree, Samuel was a Managing Director of CORBU, a research firm we struck up a relationship with to deliver model portfolios. Samuel is a global macro expert focused on the investment implications of politics and policy. His PolyMacro research has been widely followed by large family offices, institutional investors and the media. Prior to joining CORBU, Samuel was the Chief Economist and Investment Strategist at Avalon Advisors. Before joining Avalon, Samuel was a portfolio manager at Chilton Capital Management, where he launched the Chilton ESG Equity Strategy and a long/short technology portfolio. Samuel started his career as the cross-asset analyst for a small hedge fund. He is the author of the book “After Normal: Making Sense of the Global Economy ”.

Original Post

Read the full article here