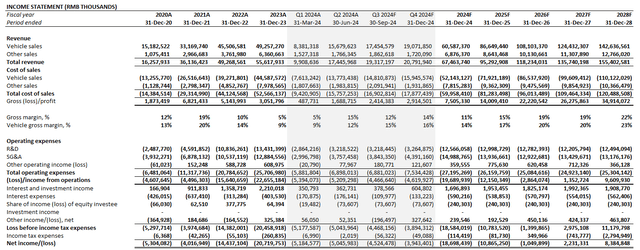

NIO Inc. (NYSE:NIO) has posted solid Q2 earnings results, with robust performance in vehicle sales and gross margins underscoring an above-estimate Q3 outlook. The company has delivered more than 20,000 vehicles on a monthly basis for four consecutive months through August. And similar strength is expected in September, which has likely kicked off with a strong start. Specifically, new car insurance registrations from NIO totaled 6,000 for the week ending September 1. Based on 20,176 vehicle deliveries completed in August, new car insurance registration volumes in the month’s final week suggests accelerated uptake heading into September. Coupled with the upcoming start of shipments for the L60 – the flagship vehicle for NIO’s ONVO sub-brand – NIO is well-positioned for another record-setting quarter.

NIO’s recent results have also delivered on management’s promise to stabilize vehicle average selling prices (“ASP”), with a substantially less severe sequential decline than Q1. This was evident in NIO’s more prudent use of promotions during the quarter, while maintaining growth in vehicle deliveries. The results also set a robust foundation for NIO’s upcoming introduction of lower-priced ONVO sales into its revenue mix. Sustained sales generated from the higher-priced flagship NIO brand represent a critical gauge for its ability to absorb the dilutive economics of upcoming lower-priced sub-brands (i.e., ONVO and Firefly). It will also support a balanced navigation through NIO’s efforts in extending its reach beyond the premium segment.

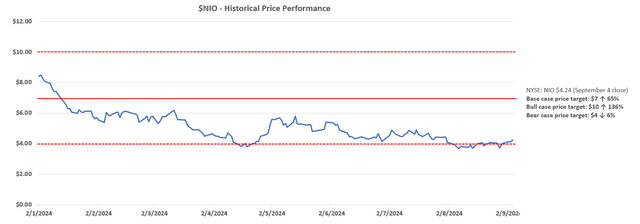

Looking ahead, we expect $4 to be a supportive bottom for NIO considering its growth outlook. NIO’s upcoming introduction of competitively priced mass market models through the ONVO and Firefly brands will not only expand its addressable market to enable incremental growth, but also contribute favorably to the scale of existing platform R&D investments. Taken together with its recent progress in navigating through China’s mixed macro backdrop and the broad-based industry price war, NIO demonstrates improved visibility towards its profitability trajectory.

Topline Considerations

NIO Q2 revenue grew 98.9% y/y to RMB 17.4 billion. Despite the slight $40 million miss from the average Wall Street estimate, NIO’s top-line performance reflects the robust sequential increase in vehicle delivery volumes, and a stabilizing ASP helped by NIO’s completed transition of its line-up to NT 2.0.

NIO’s growth results for Q2 also demonstrate stabilizing exposure to the impact of China’s mixed macro backdrop and the broader EV industry’s ongoing price war. The company’s robust delivery volumes have sustained through August, with September likely off to a strong start as well. Specifically, NIO vehicles accounted for 6,000 new vehicle insurance registrations in China for the week ending September 1. This implies the weekly delivery run-rate exiting August had accelerated. This makes NIO well-positioned for its fifth consecutive month of 20,000+ vehicle deliveries in September, which is in line with management’s Q3 delivery guidance of 62,000 to 63,000 vehicles.

We believe the start of deliveries at ONVO later this month will be a key catalyst for NIO. The company had unveiled the sub-brand’s first vehicle – the L60 mid-sized SUV – in May. It started taking pre-orders and offering test-drives earlier this month after opening more than 100 stores across China. While ONVO L60 contributions to Q3 delivery numbers will likely be nominal, the latest delivery guidance offers a strong foundation for added volumes from the new sub-brand exiting 2024.

onvo.cn

ONVO targets the “mainstream family market” at the RMB 200,000 segment, and offers comfort and experience through shared technologies with NIO. The L60 is currently taking pre-orders at RMB 219,900, and competes directly against Tesla’s (TSLA) best-selling Model Y, which starts at RMB 249,900. More importantly, more than 80% of NIO buyers have been acclimated to opting for battery leasing. This accordingly shaves RMB 70,000 off the vehicle MSRP, meaning the L60 could drop to the sub RMB 150,000 level. This makes the L60 a competitively priced product against even BYD Company’s (OTCPK:BYDDF, OTCPK:BYDDY) best-selling comparable counterparts – such as the Han, Song, and Sea Lion SUVs. The L60’s competitive price point also mitigates the premium NIO brand’s exposure to China’s mixed consumer sentiment due to the region’s extended property slump.

Further improving ONVO’s appeal to the broader Chinese consumer end-market is its shared access to NIO’s expansive power network. Based on NIO’s newest NT 3.0 platform, the ONVO L60 offers compatibility with its parent brand’s expanding network of more than 1,000 third generation battery swapping stations. ONVO also gains added access to more than 20,000 NIO Power charging stations and over 1 million third-party charging stations installed across China. The L60’s powertrain is also designed to facilitate 12.1 kWh/100 km. This implies at least 600 km of range based on the standard 75 kWh battery pack currently offered across NIO’s swap stations, which is an adequate gauge given ONVO’s compatibility with Power Swap.

And ONVO’s success in gaining brand recognition and acceptance from the Chinese household is corroborated by management’s recent allusion to pre-orders having already surpassed expectations by multiple-folds. This accordingly reinforces prospects of additive growth from ONVO on top of resilient demand on existing NIO premium models, despite the impact of China’s mixed macro backdrop and extended industry pricing headwinds.

Bottom-Line Considerations

NIO has also been exhibiting disciplined spend management on the cost front, which is corroborated by its delivery of restored double-digit vehicle gross margin in Q2. The three-point sequential gross margin expansion was primarily driven by improved delivery volumes, reduced exposure to promotion-driven sales, and further declines in material cost per unit despite the slightly lower ASP. Looking ahead, we expect a more evident impact on vehicle gross margins from material cost improvements, as well as added scale from ONVO volumes.

1. Material cost improvements

NIO’s vehicle gross margins have been expanding consistently in the double-digits through 2H23 before hitting a setback in 1Q24 due to pressure from depressed sales volumes. Much of the improvement was driven by structural price declines in key battery materials, which constitute the bulk of EV costs.

Specifically, the spot price for lithium carbonate – the key material used in EV batteries – have declined almost 90% from its peak in 2022. Meanwhile, the price outlook for copper and aluminum, which are critical components in auto manufacturing, are also expected to decline further from current levels. As a result, the average price for lithium iron phosphate (“LFP”) batteries most commonly used for powering EVs has dropped to $53 per kWh, down from $95/kWh a year ago.

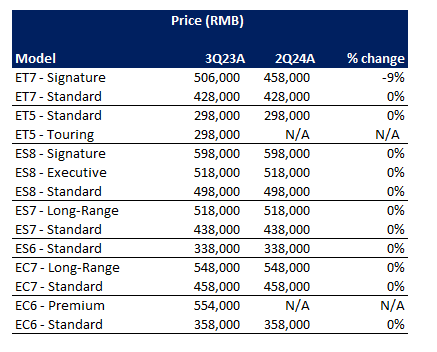

Admittedly, the decline in prices reflects the combination of weakening Chinese demand due to the region’s prolonged economic slump and broader dampening of appetite for EVs recently. Yet, the pick-up in NIO’s sales volumes recently continues to corroborate stabilizing demand at the company. This is further complemented by limited changes to the MSRP of NIO vehicles over the past year. There was the exception of a -9% y/y decline in the ET7 Signature trim’s price to RMB 458,000, despite completing 2024 version upgrades to NT 2.0 in March. NIO has also reduced its use of aggressive promotions in Q2, which is evident in the three-point sequential expansion in vehicle gross margins.

Data from nio.cn

Taken together, the impact of lower material costs per unit is expected to become more evident in NIO’s vehicle gross margin going forward, as sales volumes are expected to remain resilient while its vehicle ASP also continues to stabilize.

2. Added scale from ONVO volumes

Management has reiterated that current momentum observed in ONVO pre-orders at RMB 219,900 already “realizes good vehicle margin.” And they remain committed to ensuring a balanced approach between pushing volume and maintaining margins for ONVO despite its penetration into a highly competitive segment.

Based on commentary from the 1Q24 earnings update, management targets a long-term gross margin for ONVO at about 15% based on monthly sales of 20,000 to 30,000 units, which is comparable to Tesla’s current 16% to 17% range. Although ONVO is expected to be initially margin dilutive due to ramp up costs and its inherently lower selling price point, the additional volume is expected to become structurally accretive to NIO’s trajectory towards profitability. Specifically, NIO’s breakeven volume has been set at 30,000 units per month for the core brand, which would yield a ~20% gross margin.

And added ONVO volume is expected to facilitate these efforts, primarily due to cost synergies realized through their shared technologies. Specifically, the ONVO L60 will be built on NIO’s next-generation NT 3.0 platform. The core NIO brand will also introduce NT 3.0 through the ET9’s launch in Q1 ’25 alongside a broader upgrade for its existing vehicle line-up next year.

The NT 3.0 platform boasts a competitive manufacturing cost structure, enabling further vehicle margin improvements. The next-generation platform encapsulates more of NIO’s in-house developed technologies, including its proprietary “Shenji NX9031” autonomous driving processor, and includes design changes to enable additional battery cost savings. Management currently targets a 20% margin on NT 3.0 vehicles, which would complement NIO’s trajectory to breakeven and profitability. Given ONVO’s target margin is about 15%, this formula implies the core NIO brand, which offers vehicles at a higher price point, could exceed 20% gross margins over the longer-term.

Although NIO has yet to disclose the underlying platform for its second “Firefly” sub-brand, which launches in 1H25, the added volume will likely further its economies of scale benefit. The Firefly brand launches in 1H25, and targets the RMB 100,000 to RMB 200,000 price segment, which is currently the most popular among Chinese consumers.

Firefly vehicles will likely adopt NIO’s proprietary battery swapping technology as well, resulting in further adjacent revenue growth and improved overall operating leverage for the company. Firefly’s launch next year will likely coincide with a better built out network of supportive infrastructure across China, which includes service centers, charging stations, and battery swapping stations. This will further reinforce the brand’s appeal to EV buying opportunities currently concentrated in lower-tier Chinese cities by improving consumers’ access to a competitively priced vehicle as well as supportive infrastructure.

Fundamental Considerations

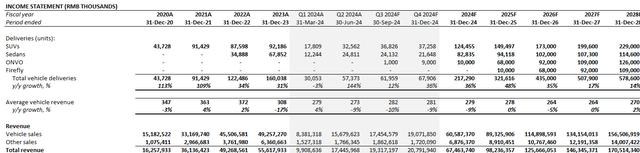

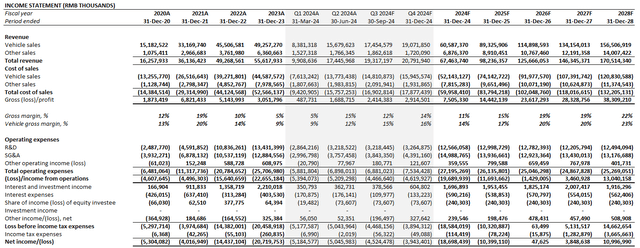

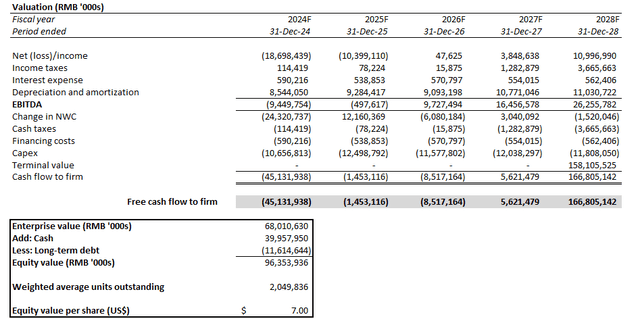

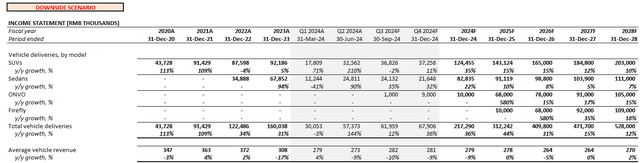

Adjusting our previous forecast for NIO’s actual 2Q24 results and forward outlook, we expect the company to expand revenue by 21% y/y to RMB 62.5 billion for full year 2024. This assumes vehicle deliveries will grow 36% y/y to more than 217,000 units this year, with about 10,000 units of added volume from ONVO’s go-to-market starting later this month.

Author

We remain confident in NIO’s capability in maintaining monthly deliveries of 20,000+ vehicles on average through 2025. The assumption is corroborated by the upcoming start of deliveries for the ONVO L60 and Firefly model in 1H25, which will expand NIO’s reach into a concentrated addressable market in China’s lower-tier cities given the competitive pricing.

This will be key to ushering NIO towards profitability exiting 2026. We expect continued margin expansion in double-digits through 2025, given expectations for improved operating leverage with added scale from ONVO and Firefly sales on top of resilient demand for core NIO brand vehicles. The assumption is complemented by the continued benefit of declining material costs per vehicle due to moderating raw material prices.

There is also an added benefit from ongoing investments through NIO Capital, which remains overlooked by investors. CVCs have gained popularity in the past two decades, with relevant deals increasing over 10x during the same period. Although investments made through CVCs like NIO Capital offer a superficial cushion to PNL by removing the immediate impact of substantial upfront R&D spend exposure, they typically offer favorable long-term economics. CVC deals currently account for almost a fifth of total VC deals, as relevant investments have proven to drive substantial improvements to internal innovations.

Specifically, NIO Capital, which is NIO’s corporate venture capital (“CVC”) arm, has been deploying billions of dollars recently towards investments in EVs, autonomous mobility, new energy, battery technology and other auto manufacturing developments. These represent speculative, yet critical investments for the company that will also preclude an immediate impact on its operating expenses. And this is evident in NIO’s stabilizing quarterly R&D spend in recent quarters, which management expects to be maintained at levels similar to 2023 despite upcoming new vehicle launches and platform upgrades.

Author

Valuation Considerations

Based on the foregoing analysis, we are setting a base case price target for the stock at $7 apiece.

Author

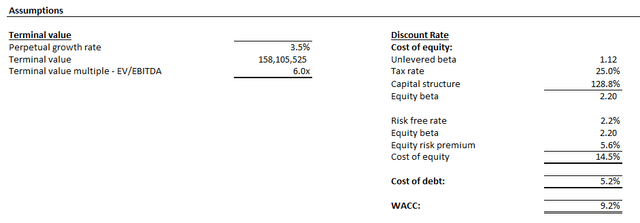

The price target is derived from the discounted cash flow (“DCF”) approach, which considers projections taken with our updated fundamental forecast for NIO, as discussed in the earlier section. The analysis applies a 9.2% WACC in line with NIO’s capital structure and risk profile. An implied perpetual growth rate of 3.5% is also considered in determining NIO’s terminal value, which is in line with China’s projected pace of economic expansion in the long-run to represent the company’s normalized growth prospects.

Author Author

Risks to Consider

Near-term ramp-up costs for ONVO and Firefly, as well as the impact of upcoming EU tariffs on Chinese EV imports, are expected to weigh on NIO’s profit margins, making it critical for the company to maintain core brand volumes. Yet, China’s mixed macro backdrop and intensifying competition in the broader EV industry remains an immediate risk to the growth trajectory expected from NIO. This could result in further depression on its ASP due to faltering volumes, which could lead to widening losses and incremental pressure on its cash burn.

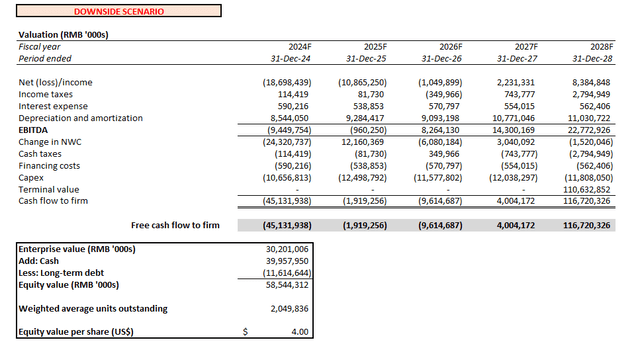

However, our sensitivity analysis performed on NIO’s fundamentals considering the downside scenario shows support for the stock at the $4 level. In the downside scenario, we expect core NIO brand vehicle deliveries to expand at a five-year CAGR in the low double-digit percentage range. ONVO and Firefly vehicle deliveries should average below 9,000 units per month each, with the added impact of ASP dilution. This would be reflective of a softening demand environment due to the combination of extended macro weakness and intensifying competition in China, which would also result in an adverse impact on NIO’s cost structure. The resulting fundamental estimates, paired with key valuation assumptions used in the base case analysis (i.e., 9.2% WACC and 3.5% perpetual growth rate) yields $4 apiece, which is consistent with the stock’s recent lows.

Author Author Author

Final Thoughts

We believe the NIO stock has bottomed at the $4 level, with its recent earnings results reinforcing upside potential. The start of delivery for ONVO represents a key catalyst in driving a much-needed uplift to the stock from current levels, in our opinion. Not only would ONVO catapult NIO into a concentrated EV demand market it previously did not have access to, but the new sub-brand would also be additive to its growth outlook and ensuing operating leverage improvements. Taken together with resilient demand observed in the core NIO brand, we believe added scale from ONVO will complement the company’s ongoing margin expansion roadmap, and improve overall visibility on its trajectory towards breakeven and profitability.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here