This article was co-produced with Kody Kester of Kody’s Dividends.

—————————————————————————–

The market is 11% overvalued at 18.6X earnings and isn’t even pricing in the looming recession yet.

Luckily, there are always great blue-chip dividend stocks that are on sale. There are three that are reasonable-to-good buys now that we will discuss below.

This trio fits the Warren Buffett investment philosophy of “wonderful companies at fair prices.”

They are 6% undervalued and can provide market-crushing long-term total return prospects.

In the coming ten years, analysts anticipate roughly 246% cumulative total returns from these three versus the 137% from the S&P 500 (SP500): superior returns from superior quality businesses.

In a constantly evolving market environment, investors need to have a proven investment strategy that they are confident they can stand by through the waves of market volatility. This is true whether the stock market is riding high in a bull market or down in the dumps of a bear market.

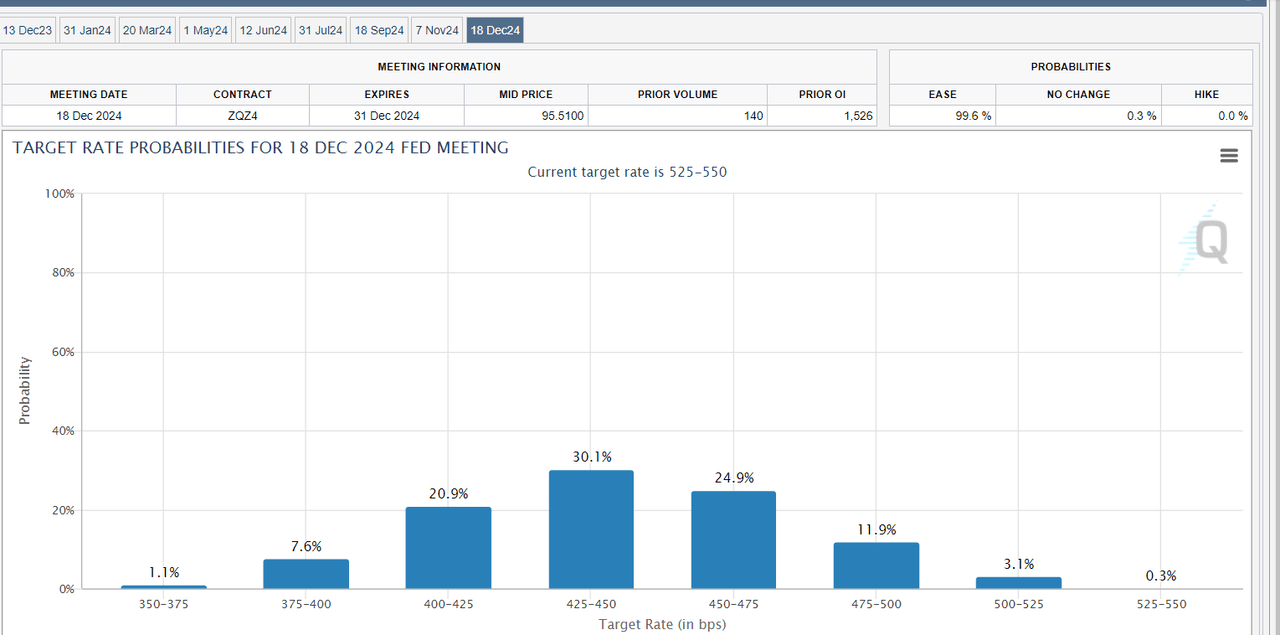

CME Fed Watch Tool

Up 18% year to date, the S&P 500 is off to the races. Bond markets are currently pricing in a 99.7% probability that interest rates will be lower by next December versus the current 525-550 basis point Federal Funds Rate. The degree of interest rate cuts is up in the air, with the most likely to be four 25-basis point cuts at a 30.1% likelihood, three cuts at a 24.9% probability, five cuts at a 20.9% likelihood, and the probability of two cuts at 11.9%.

Equity markets seem to be forgetting one important fact, though. Corporate earnings will certainly dip from current levels if interest rates are cut three, four, or even five times in the next 13 months. Implementing that many interest rate cuts that rapidly would likely mean the Federal Reserve has overshot its soft landing, putting us into a recession.

Even if, by some miracle, the Fed can avert a recession, there is arguably no historical basis upon which the current market valuation can be defended. That’s because the S&P’s current forward P/E ratio of 18.6 is about 11% above the historical norm. Adjusting current 2024 analyst earnings estimates for a standard recession, the S&P’s forward P/E ratio is even higher at 21.1.

This is all to warn that if the market were to be valued on fundamentals and facts alone, a double-digit downside would await the S&P. That’s why now is as good of a time as any to buy proven businesses at discounted valuations for the long haul. Here are three Dividend Aristocrats that could reasonably double the S&P’s expected 10-year cumulative total returns.

AbbVie: A Dividend King With A Stacked Product Portfolio And Pipeline

Since its spin-off from Abbott Laboratories (ABT) in 2013, AbbVie Inc. (ABBV) has been an exceptional performer. Inheriting Dividend Aristocrat status from its parent company, AbbVie, has since become a Dividend King with 51 years of dividend growth to its credit. Token raises haven’t characterized the past decade of dividend growth. AbbVie’s quarterly dividend per share has soared by 287.5% to the $1.55 dividend set to be paid next February.

This spectacular dividend growth was all made possible by the miracle immunology drug Humira, becoming the world’s top-selling drug for several years, reaching $21.2 billion in peak annual net revenue in 2022. Due to the entry of several biosimilars into the U.S. market this year, the immunology smash-hit lost its top-selling designation. Beyond the 19% adjusted diluted EPS decline expected in 2023 and the 1% adjusted diluted EPS decline for 2024, the company should regain its footing.

AbbVie’s management is very upbeat on the future of its two current-gen immunology drugs, Skyrizi and Rinvoq, and they have every reason to be. The two drugs grew at over 50% annualized rates in the first half of this year to combined annualized sales of approximately $10 billion. Continued market share growth on currently approved indications can sustain growth in the two drugs. With other blockbuster indications in the works for hidradenitis suppurativa and lupus, management thinks the duo can top Humira’s peak revenue within the next few years.

Keep in mind we’re also not considering growing blockbuster drugs like the anti-psychotic Vraylar, Botox Therapeutic, and the like. Looking out past the next few years, AbbVie also has more than 50 programs in mid and late-stage development. For these reasons, FactSet Research believes the company’s earnings will compound by 7% annually in the long term.

Once AbbVie moves past the brunt of its Humira patent cliff and its non-Humira platform moves the growth needle again, dividend growth could pick up. According to our findings, AbbVie’s EPS payout ratio is just 51%, which will be close to the bottom for earnings. For perspective, that is below the 60% rating agencies view as sustainable for the pharmaceutical industry. AbbVie also enjoys a BBB+ credit rating from S&P on a stable outlook. That implies the 30-year risk of bankruptcy is about 5%.

Even with all it has going for it, the market stubbornly can’t look past its nose when it comes to AbbVie: Historical valuation metrics like dividend yield and P/E ratio value the stock at $149 a share. Given the current $138 share price as of November 21, AbbVie is about 7% undervalued.

If the company grows as expected and returns to fair value, here is what total returns could resemble in the next ten years:

-

4.5% yield + 7% annual earnings growth + 0.7% annual valuation multiple expansion = 12.2% annual total return potential or 216% cumulative total returns versus the 9% annual total return potential of the S&P or 137% cumulative total returns

FAST Graphs, FactSet

FAST Graphs, FactSet

Air Products and Chemicals: The World Can’t Live Without Industrial Gases

Many of the best businesses in the world are so ingrained in our lives beyond the most obvious ways that we don’t even appreciate their impact. Air Products and Chemicals, Inc. (APD) is a classic example of this in action. The company’s industrial gases (e.g., carbon dioxide, hydrogen, nitrogen, etc.) serve as critical inputs in dozens of industries that keep the world running, including electronics, manufacturing, and food and beverage.

investor presentation

Do you see the demand for pharmaceuticals and consumer electronics declining over the long run? As long as the world keeps growing in population and wealth, short of a nuclear war, I don’t see that happening. In that case, we will fight for survival, and our investments won’t matter. That is why FactSet Research projects that APD’s earnings will rise by 11.7% annually for the long term.

For 41 years, the company has grown its dividend. In the last decade, the payout has grown by 10% annually. The EPS payout ratio of 61% aligns with the 60% rating agencies prefer; the company should have no problem extending its dividend growth streak. That’s especially true when considering APD’s A credit rating on a stable outlook from S&P, which implies a 30-year bankruptcy probability of just 0.66%.

The stock appears to be 7% undervalued from the current $276 share price relative to the $297 fair value estimate. If APD returns to fair value and meets growth expectations, here are what total returns could look like for the coming ten years:

-

2.6% yield + 11.7% annual earnings growth + 0.7% annual valuation multiple upside = 15% annual total return potential or a 305% cumulative total return

FAST Graphs, FactSet Research

PepsiCo: A Portfolio Of Universally Recognized Brands

Finally, our most consumer-oriented business is PepsiCo, Inc. (PEP). The snack and beverage conglomerate’s portfolio comprises 500+ brands, including the eponymous Pepsi cola, Gatorade sports drink, Lay’s potato chips, and Aquafina bottled water. Thanks to these legendary brands, PepsiCo’s products are consumed over a billion times daily worldwide.

The company’s world-class brands provide it with great pricing power. Though its volume declined 6% in the third quarter, Yuval Rotem points out this is probably because of PepsiCo’s 12% price hikes. Thus, the company maintained its industry-leading operating margin of 28% for the quarter.

Earnings growth should remain solid as the company executes bolt-on acquisitions and incrementally lowers its share count through share repurchases. FactSet Research predicts that annual earnings will grow by 9% annually.

Along with a sensible EPS payout ratio of 66% (the industry safe guideline is 70%), this should give PepsiCo free rein to prolong its 50-year dividend growth streak. Additionally, the company’s A+ credit rating from S&P on a stable outlook puts it at just a 0.6% chance of closing by 2053.

PepsiCo’s $173 fair value also suggests shares are 3% undervalued relative to the current $168 share price. If the company matches the growth consensus and gets back to fair value, here is what investors could stand to gain from the current share price for the next decade:

-

3% yield + 9% annual earnings growth + a 0.3% annual valuation multiple boost = 12.3% annual total return potential or a cumulative total return of 219%

FAST Graphs, FactSet

Summary: Market-Doubling Dividends And Market-Doubling Total Return Potential

DK Zen Research Terminal

AbbVie, Air Products & Chemicals, and PepsiCo are three fundamentally high-quality businesses because of their investment-grade balance sheets, industry leadership, and healthy growth prospects.

On average, the three companies sport a 3.4% dividend yield (versus the S&P’s 1.5% yield), are expected to grow by 9.2% annually, and could gain 0.6% annually from a valuation multiple reversion. That comes from an average annual total return of 13.2% or a 246% total return over ten years. This is far better than the 9% annual total return potential and 137% cumulative 10-year total return potential of the S&P 500.

Read the full article here