In June 2022, I published my first article on Valens (NYSE:VLN). The stock was trading at $3.11 at the time, and over the next six months it increased by around 90% before falling back down, primarily due to deteriorating conditions in the Audio/Video. In the automotive segment, Valens penetrated additional Mercedes Benz models and revenues improved on that front.

High rates and supply chain constraints have clouded the outlook for the industries in which Valens operates. This updated article will not discuss the company’s technology, background, TAM, its benefits, or why Valens’ solutions are superior to competitors’; please see my first article here for more information.

The purpose of this publication is to provide a more in-depth analysis of the company’s financials as well as exogenous factors that will drive its growth by 2030.

Valens is currently trading at 2.20$/share.

Market developments

As inflation falls, the target markets (Audio Video – Automotive) in which Valens operates are improving.

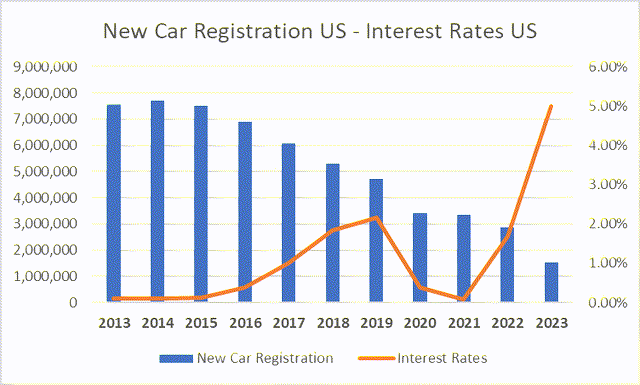

When it comes to the automotive industry, we know how high interest rates are putting pressure on consumers who are delaying purchases of new vehicles.

Interest rates and Car Registration (St. Louis FED – Graph by Author)

We know that VLN chips are used by Mercedes-Benz, which has recently shown an increase in sales and a slightly lower inventory. However, as long as automotive inventories remain elevated, I expect Valens’ revenues coming from the automotive segment to not improve as much as expected, at least for what concerns 2024. However, signs of relief appear to be emerging, with inventories plateauing/decreasing and interest rate expectations falling.

Car Inventories (SPGlobal)

Chip Lead Times (SPGlobal)

Some key variables at work here appear to be painting a slightly brighter picture. Supply chain lead times are beginning to return to pre-pandemic levels, and new car registrations in the United States and China appear to be increasing as well.

TradingEconomics

I believe the company strategically stacked inventory during supply chain disruptions to keep costs low, then slowed its inventory purchasing pace and offloaded some of the old inventory. This helped to offset some of the cash burn that occurred in 2020 and 2021.

The increase in inventories is reflected in an extended Cash Conversion Cycle, which has grown significantly since 2020 and has been partially offset by extending payable terms.

Author

As shown in the graph below, gross margins have suffered as a result of more turnover coming from the automotive segment and inventory turns have slowed significantly as a result of less activity in the audio-video segment, though inventories appear to be starting to quicken slightly and remain above 2022 levels. When asked about it, management also stated that no price increases have been imposed on VLN’s end customers. These factors, along with improved inventory in the automotive sector and lower expected interest rates, may indicate that the worst is over for this industry.

Gross Margins – Inventory Turns (Author)

Growth Opportunities

Many research firms anticipate growth as a result of the need to decentralize a car nervous system. The main driver of growth will be increased demand for more complex infotainment systems as well as security elements (such as cameras and radars), an area in which Valens expects to have significant presence.

According to Valens’ latest ESG report, its solutions allow for “the use of lightweight Unshielded Twisted Pair cables in vehicles and the adoption of zonal [emphasis added] architecture solutions for the automotive industry.”

This will be a significant revenue generator in the future. The graph below depicts the expected growth in E/E Zonal Architecture in automobiles. The concept of E/E Zonal Architecture reflects the technological shift that addresses the increasing complexity and computational demands of the automotive electronic/electrical (E/E) system.

SPGlobal expects 38% of all vehicles produced by 2034 to have zonal architecture, up from 2% in 2022.

Some OEMs, particularly in Japan and Korea, are attempting to avoid the transition to E/E zonal controls by committing to developing software-defined vehicles and introducing a centralized gateway – or body domain controller – that also consolidates the existing vehicle architecture. However, as the degree of center computing evolves, some form of local or zone ECU design is unavoidable.

The highly anticipated VA7000 family of chips (particularly the VA7031 and VA7044/42) from Valens will most likely drive the majority of the increase in revenues from the automotive segment. The timing of such contributions will be determined by when the design win is announced, after which it will take approximately 2-3 years for OEMs to fully implement the chips in their ecosystems.

Zonal Architecture (SPGlobal)

Based on a research performed by Allied Market, safety (LG Electronics Vehicle plans to start using VLN’s VA7000 in its cameras eco-system aimed at increasing safety), Telematic and Infotainment will prove to be the most lucrative areas when it comes to semiconductor chips in the automotive industry, all areas in which Valens operates and has strong advantages as well as pre-established relationships with OEMs, which as far as we know, never disputed VLN’s technology nor second questioned its effectiveness.

Allied Market Research

This raises the issue of computing and data processing with no latency. High-quality transmitters and receivers make the difference in viable solutions when it comes to chips. I recognize that competition on the transmitter front (from companies like Texas Instruments [even though TI provides analog connectivity only while Valens provides DSP]) may erode some of Valens’ market share, but the company has a technological and know-how advantage thanks to its DSP solutions. A comprehensive test conducted by JASPAR has also validated this. JASPAR performed induction noise, TEM cell, antenna irradiation, BCI, antenna irradiation radar band, wireless device, conductive noise, and radiation noise tests on the Valens VA7031 serializer and VA7044 deserializer chipsets.

A solid and reliable receiver is much more difficult to manufacture (and copy) than a transmitter, where the entry barriers are much lower. It should be noted that Valens is capable of producing a silicon integrator that incorporates both the transmitter and receiver into a single chip that can also (most of the time) be redeployed in different business segments.

Author

One major thing that I haven’t seen many people mention is that VLN offers advantages in terms of producing chips used in receivers. As OEMs strive for efficiency, the data load handled by a chip will increase linearly; what will increase exponentially is the delay caused by a small increase in data load on the speed with which data is conveyed. The problem is not linear; as the number of gigabytes increases, so does the noise. In these high-stress conditions, Valens technology appears to be superior than that of its competitors.

Furthermore, as MIPI A-PHY solutions become more widely used in the industry, management expects VLN market share to firstly increase, and as the overall market grows, its market share will be lower but the market will grow, boosting the company’s overall economics on a net basis.

The automotive semiconductor market is expected to reach $ 95 billion by 2025, with a 7.5-10% CAGR depending on the solution studied (ADAS, Connectivity, Safety).

Audio Video

In comparison to automobiles, the audio video segment appears to be less volatile and more resilient. The company has lately released a slew of updates on new USB solutions. As someone who frequently uses virtual classrooms, I can’t begin to tell you how much of a difference a smooth Audio-Video interactive environment makes in someone’s learning experience; this is a component that consumers and service providers are rapidly recognizing.

In terms of verticals, management plans to tap new solutions in sectors where Valens has previously demonstrated a competitive edge. Most significantly, management has voiced confidence in the company’s ability to grow its foothold in the industrial and medical audio-video industries.

Valens’ Audio-Video systems are versatile enough to be used in a variety of applications (Industrial, Medical, Engineering, Learning, Factory Automation, Logistics, and so on). By 2032, the medical camera market alone is anticipated to be worth $6 billion. Some medical cameras might cost as much as $10,000 USD. The industrial camera market is predicted to expand from 1.8 billion US dollars in 2022 to 3.6 billion US dollars in 2031.

Research and Markets

Another noteworthy development is the rise in the number of meetings held in huddle rooms. Roughly ten percent of all conference rooms would be considered huddle rooms prior to 2020. Forecasts from Frost & Sullivan indicate that by 2024, huddle rooms will host about 75% of video meetings. Because a huddle room is smaller than a conference room, a separate camera setup is required. Webcams are designed for single users alone; they won’t work in a huddle room which instead requires a different apparatus. Along with Logitech, Valens provides a broad range of solutions that will help the business capitalize on this emerging trend. Most recently Valens introduced new products applicable to this market, for example the high-performance USB3.2 Gen1 peripherals can be extended up to 100 meters/328 feet via category cable with Valens Semiconductor’s VS6320. It supports all USB transmission protocols (BULK, ISO, INT, Control), as well as specialized control signals (UART, GPIO) via category cables. It also supports USB3 (Superspeed 5Gbps) and USB2 (480Mbps). The VS6320 will work with the soon-to-be HDBaseT-USB3 standard.

VALUATION

This section will expand on my valuation model.

I believe previous Valens research focused too much on the “short term” catalysts, such as the threats posed by high interest rates (particularly on Valens’ end clients), without taking into account how quickly the TAM and SAM are expected to grow. When it comes to evaluating a business, a growing end market is critical. It appears that analysts have placed too much emphasis on competition without realizing that the addressable market will likely expand much faster.

To summarize, I used three valuation methods: EBITDA multiple – P/E Multiple – DCF, and then applied three different scenarios (Base, Best, Weak) to allow the model some room for error.

My base scenario projects:

- 2030 Revenue to be $ 665.25 million (29.6% CAGR 2023 – 2030), in its F4 management expected revenues to be >$1B company by 2030, 2026 revenues were expected to be around $480M (Base 2026 revenues in my model stand at around $201.5M). I do believe management expectations came down a bit from their F-4 SEC filing publication

- 2030 Free Cash Flow to be $ 133.98 Million

- 2028 EBITDA to be $ 133.1 million (EBITDA margin 27.6%)

- Current EV: $80.95 million

- WACC used: 13%. This is a bit higher than what advised by financial providers in order to incorporate a sizable amount of conservativeness in the model. Financial providers show WACC should hover around 9.5-11%

- Valuation derived:

- DCF: $8.65/Share (25% weight)

- EV/EBITDA: $7.32/Share (50% weight)

- P/E multiple: $ 6.66/Share (25% weight)

- Target Price: $7.49/Share, representing a 240% upside potential.

- I consider the current valuation to be extremely attractive and to offer substantial margin of safety.

Excel Model – Base Case (Author)

The growth in revenues from 2025 to 2028 will be sustained by the introduction and subsequent implementation of the VA7000 chips in the Automotive segment. Design wins should be announced in 2024. 2023 has been the year in which VLN’s chip have been fully deployed in Mercedes Benz’s lineup.

Revenue Trend (Author)

The revenue mix from 2019 to 2030E is summarized in the graph below. The automotive segment is driving revenue growth. Automotive contributed only 2% to revenue in 2019, but management expects it to increase to 30% in 2023 (from less than $1 million to around $25 million, a CAGR of around 90%). This serves as the foundation for the excel model’s drivers, and more emphasis is placed on opportunities originating from the automotive sector of the business. This is also where the company appears to be directing the majority (around 70%) of its R&D expenditures. The automotive industry has lower margins than the audio-video industry.

Revenue Mix (Author)

For what concerns the Discounted Cash Flow, a summary is attached below. Discount rate used: 13%.

Free Cash Flow – DCF (Author)

Even if I use my worst-case EBITDA figure of $42 million for 2026, the company is currently trading at a 1.9X multiple.

Author

Here’s a quick rundown of the Enterprise Value calculation:

Enterprise Value (Author)

The table below provides more color to get to target prices using an EV/EBITDA multiple. The share count is increased by taking into account the current number of RSUs and stock options outstanding and assuming that the company will continue to issue stock as compensation (absolute values can be found in my model above).

Valuation Table (Author)

The following target prices are derived using my base case scenario for an EV multiple method and P/E multiple methods:

Author

These are the multiples and variables utilized to get to those figures:

Valuation Scenarios (Author)

This demonstrates how Valens is now underpriced regardless of the methodology employed. Short-termism and the company’s lack of popularity are factors that affect the pricing. A more reasonable valuation will probably be given to the business as soon as its potential is acknowledged. At these prices, this stock is quite appealing to purchase.

Valens as a target

As some of you may have speculated, current valuations may appear appealing to a strategic and opportunistic buyer. I believe we all agree, management included, that current valuations do not accurately reflect the company’s potential. Management should carefully consider whether an acquisition would have an opportunistic print if approached. There are also several outstanding warrants that should be managed in the event of an acquisition, which would either mean adjusting the strike price in a stock based acquisition or provide some sort of cash consideration to holders in a cash based acquisition.

Risks:

- Exogenous macroeconomic factors (interest rates remaining elevated)

- Design wins not materialized (that would be a very negative event)

- Hostile takeover at current valuations

- Competition and alternative connectivity solutions

- Recession

Read the full article here