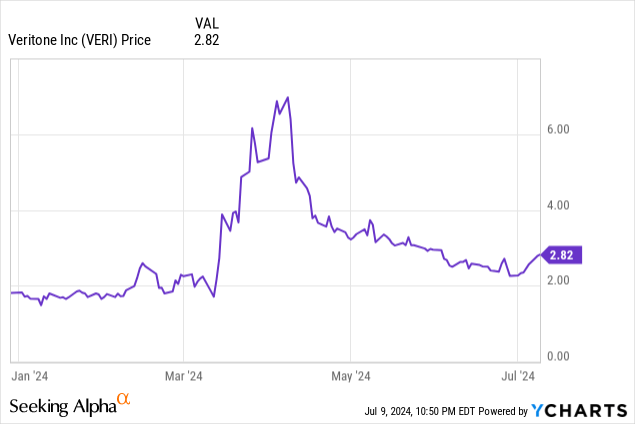

Overexcitement in AI has led to sharp rallies in many stocks this year, including many which scarcely deserve to rally. In this bucket belongs Veritone (NASDAQ:VERI), a quasi-software company and part-advertising agency that has seen its share price surge more than 50% year to date.

The company has burned off a lot of the gains it made earlier this year, and in a bid to extend its liquidity, the company also recently filed a $300 million mixed shelf offering to bolster its <$100 million in cash reserves remaining. It has also laid off a chunk of its staff, expecting to get to profitability by the fourth quarter of this year.

Still, amid all of these initiatives, I think Veritone has even more room to slide further.

I last wrote a bearish note on Veritone in March, when the stock was trading near $5 per share. Even now, at just shy of $3 per share, I’m retaining my sell rating on Veritone as even more core indicators have decayed.

The operative issue for investors to understand about Veritone is that while it tries to bill itself as an AI company, it’s really more of a grab bag of businesses.

Its largest “AI” product is called Veritone Hire, which is the rebranded version of a talent, a recruiting software company that it acquired in 2021 called PandoLogic. There are a number of issues with this business, including the fact that it had an overexposure to a single customer, Amazon (AMZN), which significantly cut its bookings (which we can see in the company’s financials, to be discussed in the next section). The second problem is that in this space, Veritone is competing with much bigger name brands in HR software, including the likes of Workday (WDAY) and SAP (SAP).

The company also operates a quasi advertising agency, which was Veritone’s original business prior to pivoting into AI. It does have some notable clients here including Chewy (CHWY), but growth is sparse and margins are nowhere near as attractive as software.

In addition to these core businesses, Veritone also has recently launched an AI consulting business (though it’s unclear if Veritone has any cachet in this realm with which to court real customers) and also does contract work with public sector clients.

Trends across these businesses are rather soft, with few growth catalysts on the horizon. And with a limited balance sheet that carries more debt than cash, I’m more inclined to sell this stock and remain on the sidelines.

ARR continues to diminish while customers churn

Despite Veritone’s year-to-date rally, the company has continued to print very disappointing results. Investors should be most attuned to how Veritone’s software businesses are performing, as these are the margin drivers that could eventually push the company to profitability: unfortunately, trends here are quite dire.

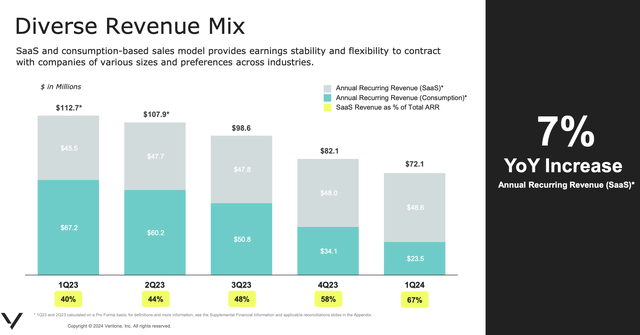

Veritone ARR (Veritone Q1 earnings deck)

As shown in the chart above, Veritone’s ARR (annual recurring revenue, one of the most important metrics for any subscription software business) has been in perpetual decline, down -37% y/y to $72.1 million. The company attributes the bulk of this decline to Amazon’s pullback (which was on a consumption or usage basis rather than subscription), and touts the fact that subscription ARR is still up 7% y/y. Still, overall falling ARR speaks to the weakness of PandoLogic/Veritone Hire’s viability in the marketplace.

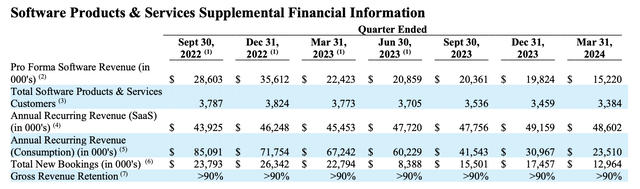

It’s not just Amazon, either. Total customers continue to fall: as shown in the chart below, software customers declined to 3,384 in the most recent quarter, a reduction of 75 customers sequentially and down -10% y/y.

Veritone trended metrics (Veritone Q1 earnings deck)

Perhaps even more egregiously, new software bookings of $13.0 million are down -26% q/q and -43% y/y. This should be the first signal that Veritone is hardly an AI company when its AI peers are all growing substantially.

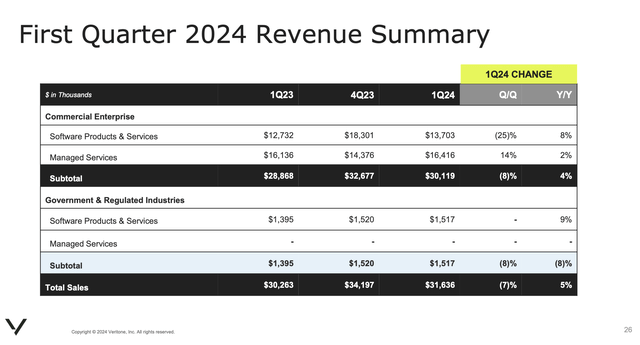

Veritone revenue by segment (Veritone Q1 earnings deck)

The main bright spot was a minor 9% y/y growth rate in government-related software revenue to $1.5 million, as the company signed on a number of new government agencies for services like automated audio redaction from surveillance tapes. Still, at such a small chunk of revenue, this is not nearly enough to offset large y/y bookings declines in enterprise.

Thin balance sheet

Ultimately, Veritone’s ability to keep limping onward will be limited by its balance sheet – which is the reason it has proposed a new $300 million raise (even if successful, either an equity or debt raise in current markets will be very expensive for the company).

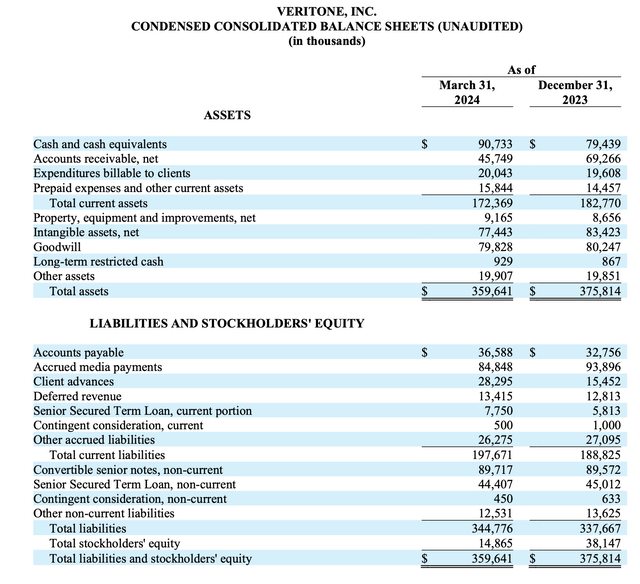

Veritone balance sheet (Veritone Q1 earnings deck)

Its most recent balance sheet, shown above, has only $90.7 million of cash remaining, and that’s against $141.9 million of total debt. The $89.7 million convertible portion of the company’s debt is due in late 2026.

The company is banking heavily on recent layoffs (13% of the company’s headcount) to push Veritone to profitability by Q4 of this year, and for the full year FY25. Per CFO Mike Zemetra’s remarks on the recent Q1 earnings call:

Turning to our cost savings initiatives. Including March 31, 2024, we have executed over $37 million of annualized savings since the beginning of 2023. During Q1 2024, we completed over $13 million of annualized cost reductions, which is included in our full year and Q2 2024 financial guidance.

On top of this phase of reorganization, we expect future synergies, both cost and revenue, to materialize in the latter part of fiscal 2024 – largely from integration of past acquisitions across our Software Products and Services lines. The Q1 restructuring included organizational realignments within sales, engineering, and corporate, the result of which was a reduction of approximately 13% of our global workforce […]

We expect we will be cash flow positive on a non-GAAP basis as early as Q4 2024. Further, and assuming modest revenue growth in fiscal 2025, we should be cash flow positive on a non-GAAP basis for the entirety of fiscal 2025.”

The key dependency, however, is that Veritone needs to grow modestly in 2025. The best forward-looking indicator of the company’s software business is its new bookings, which are declining sharply. With these trends, it’s tough to believe Veritone is anywhere near out of the woods.

Key takeaways

In my view, Veritone continues to be a rat’s nest of problems: eroding ARR, churning customers, weak new bookings, limited liquidity, and very few AI tailwinds to spark new growth for the company. Continue to steer clear here.

Read the full article here