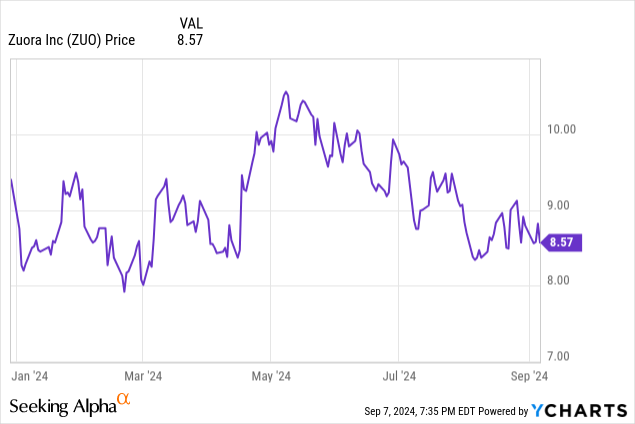

Once a tech company has entered into the penalty box, it can be very difficult to get out. Such is the case with Zuora (NYSE:ZUO), the software platform that helps fellow subscription-based revenue companies manage their billings. Despite a red-hot stock market fueled by the prospect of interest rate cuts, shares of Zuora have only been about flat year to date, vastly underperforming the S&P 500 and other tech names.

It’s in these value names, however, that some of the most prudent investment opportunities exist amid expensive market conditions. With Zuora dipping further after releasing Q2 results, I encourage investors to take a hard second look at this company.

Focus on profit expansion rather than ARR commentary; the bull case remains bright amid a cheap valuation

I last wrote a bullish note on Zuora in May, when the stock was hovering in the mid-$10s. Since then, the company’s stock has sunk by ~10%, while also releasing Q2 earnings in early August in what can technically be considered a beat-and-raise quarter. With this in mind, I’m reiterating my buy rating for Zuora.

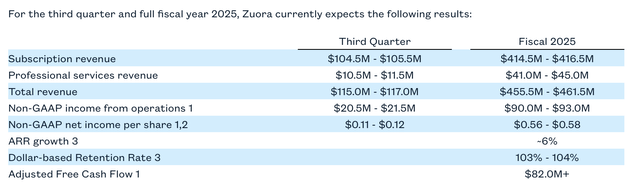

We’ll discuss the controversial outlook first. Zuora posted strong sales execution in Q2, which allowed the company to slightly raise its full-year revenue outlook to $455.5-$461.5 million, or a growth range of 6-7% y/y (versus 7% y/y growth in the first half of FY24). At the same time, we should also applaud the company for materially boosting its profit outlook, to a midpoint of $91.5 million in pro forma operating income (20% operating margins), a 13% increase versus its prior midpoint.

Zuora outlook (Zuora Q2 earnings release)

That being said, it wasn’t all good news: hence the trepidation post-earnings. The company brought down its expectations on dollar-based net retention rates to 103-104% (from 104-106% previously), and its ARR growth expectations down to 6% from a prior view of 8-10%. The company has cited weaker expansion trends as well as heightened churn, which are bigger factors for revenue in the following year, and beyond.

Of course, we have to take all of this in context against Zuora’s much cheaper valuation. At current share prices near $10, Zuora trades at a market cap of $1.30 billion. After we net off the $543.5 million of cash and $365.3 million of debt on Zora’s most recent balance sheet, the company’s resulting enterprise value is $1.12 billion.

Meanwhile, for next year FY26 (the year for Zuora ending in January 2026), Wall Street analysts have a consensus revenue estimate of $493.7 million for the company, or 8% y/y growth. If we also apply FY25’s guided 18% FCF margin against that revenue, FCF would be $89 million. As such, Zuora’s resulting valuation multiples sit at:

- 2.3x EV/FY26 revenue

- 12.6x EV/FY26 FCF

To me, these are quite bargain-oriented multiples for a company that has started to shift its focus to expanding profit margins. Here’s a refresher as to my full long-term bull case for Zuora:

- Zuora caters to subscription-based business models and is the category leader in this niche. Given the fact that more and more businesses are adopting this type of model, Zuora’s base of potential customers has widened significantly. Zuora’s uniqueness in this regard is also important to point out: companies can choose a regular ERP, but Zuora’s subscription-focused solutions help to address common pain points.

- Gross margin leverage. A better subscription versus professional services revenue mix has helped Zuora lift its gross margin profile to life-to-date highs, reversing a common concern investors had with this stock at the time of its IPO.

- Expanding profitability. Though Zuora’s lower growth precludes it from joining the “Rule of 40” club, it does operate at a score of 30, and the company’s internal management framework also hinges on maintaining this metric.

- A potential acquisition candidate given its low purchase price. While I never like to base any investment decision based on high hopes that the company will get acquired, Zuora checks off a lot of boxes for being acquired: it’s small with just a ~$1.5 billion market cap; it offers a very unique product that many larger software companies may want to get their hands on, especially during times when organic growth is fading; and it has positive pro forma operating margins.

The market doesn’t have a lot of bargain options left, but Zuora is a great choice. Buy here and wait patiently for the rebound.

Q2 download

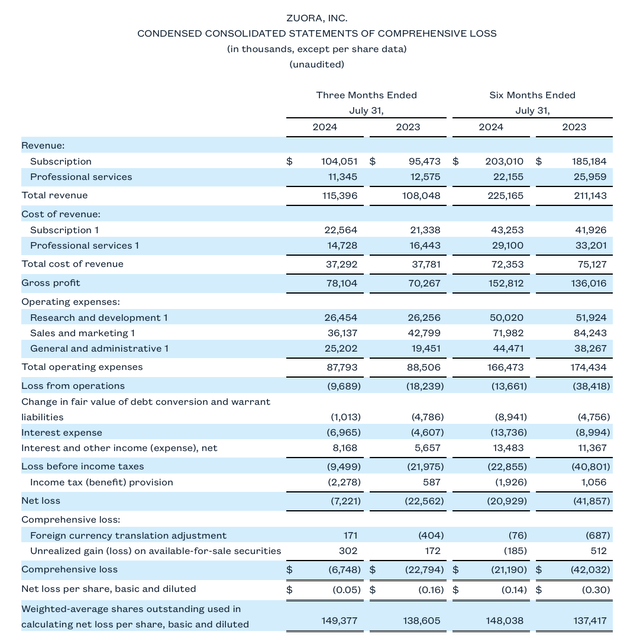

Let’s now go through Zuora’s latest quarterly results in greater detail. The Q2 earnings summary is shown below:

Zuora Q2 results (Zuora Q2 earnings release)

Zuora’s revenue grew 7% y/y to $115.4 million, easily edging out over Wall Street’s expectations of $112.6 million (+4% y/y), while also accelerating slightly from Q1’s 6% y/y growth pace.

Success in the quarter was driven by a number of successful upsells: for example, Zillow (Z) added the Zuora Revenue product to automate its revenue recognition processes alongside its existing use of Zuora Billing. The company notes that it scored two deals in the quarter with an ACV (annual contract value) of $1 million, both of which were from the existing install base. Management also notes that system integrator partners have been instrumental in bringing the company new and upsell deals with over $0.5 million in ACV.

In spite of these successes and the Q2 revenue beat, the company still sounded off cautious commentary on the net retention environment, citing macro concerns. Speaking to the ARR guidance reductions on the Q2 earnings call, CFO Todd McElhatton noted as follows:

For the full fiscal year ’25, we are raising both our revenue outlook and our non-GAAP operating income ranges as well as increasing our target for adjusted free cash flow. It is worth noting that the Subscription revenue includes the revenue share from payment processors that are not included in the ARR […]

Based on current buying behavior, we believe it is prudent to adjust our outlook for the fiscal year with DBRR to be between 103% and 104% and ARR growth of approximately 6%. Double-clicking on ARR, we have a robust pipeline with some hefty opportunities within our install base customers, but given the current environment, I remain prudent about how we set expectations for the second half as a precise timing can be difficult to predict.

You will continue to see us drive our bottom line leverage and maintain our goal of exiting fiscal 2025 at a Rule of 30 run rate. Based on our solid performance in Q2, we are increasing our guidance for adjusted free cash flow to be $82 million or greater for the full year.”

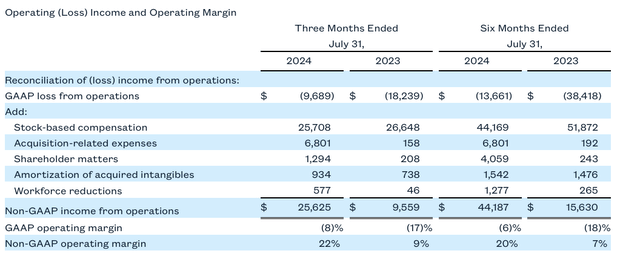

The company’s focus on profitability, however, is important to keep in mind alongside the more cautious top-line outlook. You can see in the chart below that pro forma operating margins expanded 13 points y/y to 22%, with the company committing to maintaining a “Rule of 30” balance by the end of the year:

Zuora operating margins (Zuora Q2 earnings release)

Key takeaways

Zuora is hardly the most exciting growth stock on the block. That being said, it’s still showing steady high-single digit revenue growth, a unique product catering to subscription companies, vastly expanding profit margins, and a bargain-basement valuation. Stay long here and buy the dip.

Read the full article here